We do not expect to see another episode of strong and fast US dollar strengthening against the majors, at least this year, and instead, believe that the dollar should find some support around recent levels.

A more hawkish stance from the Fed could trigger a re-coupling of the US dollar and Fed expectations, but even in this case, our core expectation is for the dollar index (DXY) to remain in a range-bound environment in near term but to remain prone to some bouts of volatility.

Volatility in the US Dollar Index was seen returning back to normal levels in the week following the UK vote and is likely to continue declining into the new week that starts off with Independence day in the United States. The end of the week is expected to see a pick-up in volatility on the release of US payroll numbers.

It has global repercussions, in particular in the commodity and commodity-linked assets space. The commodity complex embarked on a multi-year downward trend: the supply glut theme become “in vogue” as supply became resilient given that commodity producing countries saw a sustained weakening of their currencies. In recent quarters the global demand is below 1%.

How will this impact our commodity/FX space?

We expect dispersion to increase in the commodity complex as fundamentals return to the spotlight in the context of a range-bound US dollar going forward.

We have a bias towards the energy space versus industrial metals.

Gold has become more appealing to investors since the start of the year, but we do not expect the stabilisation and recovery of inflation expectations to trigger a hedging panic.

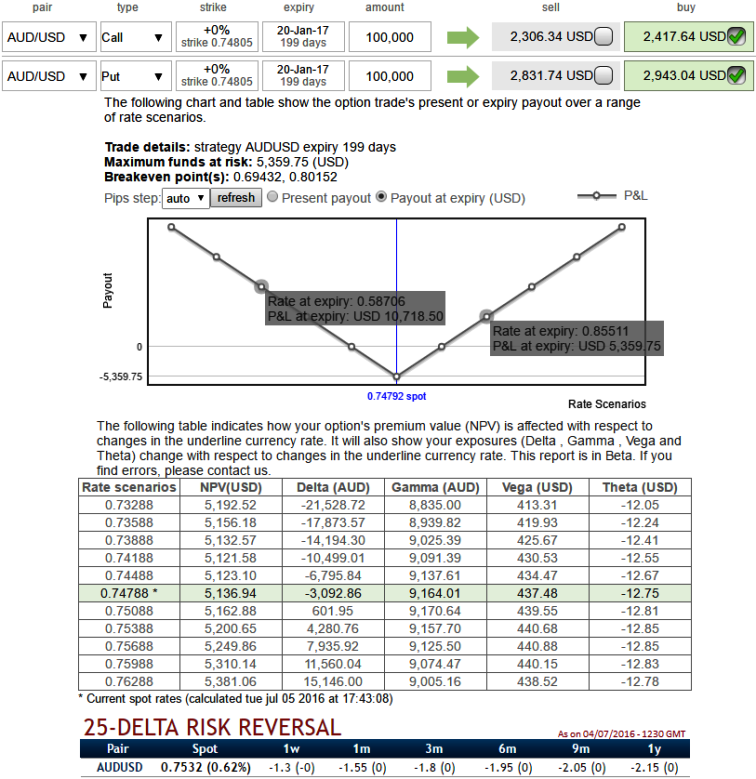

As a result, Aussie dollar in long may shift either side, so for such sceptic investors can initiate longs in AUD/USD 1y ATM straddles bidding on long-term risk reversals of this pair.

Long commodity-linked currencies basket versus US dollar.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings