Cable’s prices are trying to break down although intra-day price action remains very choppy. A move through 1.1270 would add further conviction to our view that prices should re-test and potentially break the previous 1.1215 lows.

On Wednesday the House of Commons will decide whether it will force May to postpone Brexit in case of a no deal scenario. Any MP keen to avoid a no-deal Brexit would be bonkers to let that opportunity go by. We, therefore, understand that many FX market participants consider the recent development to be GBP positive and that GBP-USD was able to establish itself above 1.3050 levels.

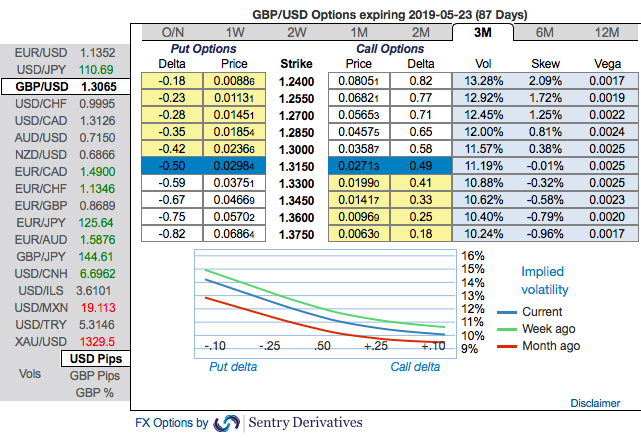

We see the minor shift in risk reversals of longer tenors but major bearish hedging sentiments remain intact in near terms, positive bids are observed in the GBPUSD risk reversals of 3m – 1y tenors. While positively skewed implied volatilities of 3m tenors also show hedging interests in bids for OTM puts that signal bearish risks.

We reckon that the sterling should not suffer like before, but, one should not disregard the Fed’s hiking cycle on the other hand. The market has always ignored the fact that all the current BoE interest rate moves are due to a favorable result of the Brexit process.

Both the speculators and hedgers of GBPUSD are advised to capitalize on the prevailing price rallies for bearish risks and bidding theta shorts in short run (1m IVs) and 3m risks reversals to optimally utilize delta longs.

Strategic Options Recommendations: On hedging grounds, fresh delta longs for long-term hedging comprising of ATM instruments and OTM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way: Short 1m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, initiate longs in 3m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium.

Thereby, the above positions likely to address any abrupt upswings in the short run and bearish risks in long run by delta longs. Courtesy: Sentrix & Saxobank

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 49 levels (which is bullish), and hourly USD spot index has bearish index is creeping at -109 (bearish) while articulating (at 07:50 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts