The Mexican peso continues to be among the worst performing currencies in EM, depreciating by 19% on a total return basis year to date and outperforming only ZAR and BRL.

This underperformance has been driven by several factors:

1) Long MXN positions reductions given higher EMFX risks;

2) The large growth hit due to covid-19;

3) Multiple downgrades by ratings agencies due to fiscal/debt sustainability concerns; and

4) A lagged response to the virus.

MXN Valuations are attractive at current levels on multiple metrics. Our financial fair value rolling 5yr regression model (which is seldom triggered) has opened a short USDMXN position in recent days as the residuals moved through 2-stdev (MXN cheap: refer 1st chart). Medium term models also screen MXN as cheap: JPMorgan’s BEER models flags MXN REER as 16% cheap as does comparing it to its 10 year average (15% cheap). The central bank’s message of gradualism this week may also help to ease pressure on MXN, as real rates are lowered more slowly in Mexico relative to other EM countries.

From a longer term perspective, once the situation has calmed down again and investors begin investing in EM asset once again, it might help the peso that interest rates in Mexico are comparatively high (we only expect moderate rate cuts this year to 5.75%). Until then investors are more likely to be driven by concerns that both monetary and fiscal policy have reacted only moderately to the deterioration of the economic situation. The peso should therefore continue to struggle.

OTC Updates and Options Strategies:

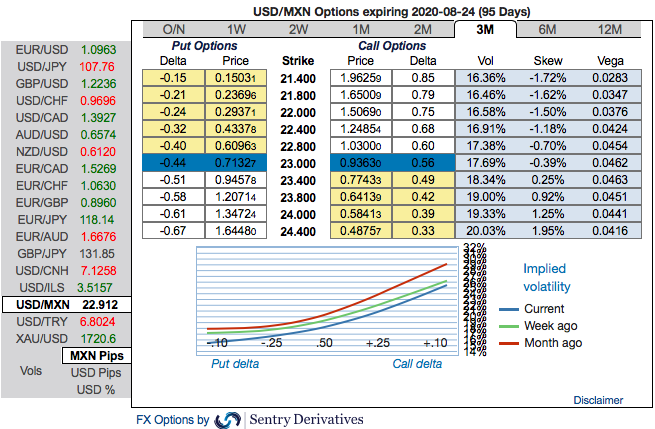

As stated in our previous posts, the positively skewed IVs of USDMXN of 3m tenors have delivered as expected and have still been indicating upside risks, while IV remains on lower side and it is perceived to be conducive for options writers.

Considering the current MXN skew setup and the receding risks for MXN spot we are open to taking the gamma risk in order to more efficiently reap the extra OTM vs ATM premium on MXN put side. 1*1.5 MXN ratio put vol spreads have shown strong and almost equivalent systematic returns for USDMXN and EURMXN over last few years.

3M USDMXN ATM/25D 1*1.5 vol ratio call spread vs 22.80/25.77 indicative (spot reference: 22.90 levels). Courtesy: Sentry & Commerzbank

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty