In this write-up, we emphasize on Yen ahead of monetary policy from the region’s central banks. Yen FX markets are likely to sense some turbulence, and accordingly, we advocate below speculative options strategies amid the central banks’ monetary policy seasons in the UK, BoJ, and New Zealand. BoE has maintained its key rate unchanged, while RBNZ is scheduled for September 26th. The NZD is under pressure on the back of dovish rhetoric from Governor Wheeler, while the GBP remained calm but little bearish bias following its recent gains against major pairs.

Likewise, the Bank of Japan meets today and is scheduled to announce its monetary policy on Wednesday morning European time. We expect the BoJ to keep its policy unchanged and for Governor Haruhiko Kuroda to reiterate a relatively dovish stance, signalling that the BoJ intends to keep interest rates at current levels for a longer period of time. We expect the BoJ to keep its current policy intact until the end of 2019 at least.

Bullish JPY: JPY has been underperforming and became the third-weakest currency among the G10 and depreciated by 0.5% in trade-weighted term. Since USD was also not strong among the G10 in the period, JPY depreciated just 0.5% against USD in the period.

Bullish JPY: Some put spreads must have been expired in USDJPY as the underlying spot FX spiked a bit. We now maintained shorts in AUDJPY but switch from options to cash.

The slippage in the S&P this week was too little too late to make a dent in USDJPY and the put spread we had in the pair consequently expired OTM. Nevertheless, it gave a kicker to AUDJPY, which was also hit by the further increases in Australian bank lending rates and what at times felt like proxy selling for further EM stress.

As discussed in the introduction we believe AUD is vulnerable from an extension of the move in EM currencies and the slow bleed from US monetary policy (average earnings in this sense were a worrying development for high-beta FX), even if the bar for the market to price RBA rate cuts is high and a lot higher than in NZ seeing how the economy managed to grow 4% in 1H.

The AUDJPY put has residual maturity of only two weeks; hence, we take profits and establish a cash short to maintain exposure to the theme.

Long a 3m AUDJPY put, strike 77.50, short a 3m AUDJPY 81.25-83.50 call spread. Received 0.5bp on June 20th. Unwind at +0.16%. Sell AUDJPY in cash at 79.27, stop 80.86.

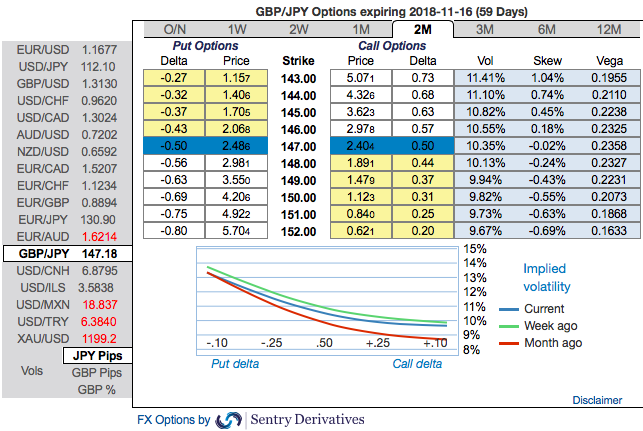

As the 2m GBPJPY skews are signifying bearish risks, at spot reference: 147.19 levels, short 2w (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, go long in 2 lots of delta long in 2m ATM -0.49 delta put options. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing at -15 levels (which is neutral), while hourly JPY spot index was at -104 (bearish) and NZD is at 65 (bullish), while articulating at (10:36 GMT). For more details on the index, please refer below weblink:

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons