We reckon that the upcoming weeks have been the stimulants of bears in pound sterling and for the US dollar. The central banks in both continents are so cautious on tail risks attached to their economy because of which their official sending dovish tone in the respective monetary policies.

Polls indicate a tight race ahead of the 23rd June UK referendum on EU membership. While we still expect the UK to remain in the UK, the risk of a Brexit is non-negligible. The binary nature of the referendum outcome, and thereby the expected GBP move, would normally favor options to reduce risk.

Bank of England (BoE) notes softening of demand, with investments in particular disappointing in Q1. Furthermore, the central banks see a risk that consumption growth, while having been firm, could slow as households defer consumption and increase savings.

Since the November peak, the sterling TWI (trade weighted index) has depreciated by 8 percent (of which Bank of England in their latest Monetary Policy Report estimates half to reflect a Brexit risk premium).

As a result, we reckon that the BoE would leave its Bank Rate and Asset Purchase Target levels unchanged on 16th June. Barring a truly shocking result, the focus thus shifts to the official statement to follow the announcement.

On the contrary, the Fed's on hold for now and probably until after the Presidential Election and that's all that matters.

In the recent speech by Fed Chair Yellen in Philadelphia, it reaffirmed a desire for gradual interest rate increases and could have been read as a sign that the FOMC isn't going to be deterred by one month's weak employment data.

The Fed was no different and somehow conspired to under-deliver even relative to the underwhelming level of market expectations. The Fed cut its rate projections substantially again this week, again undermining the dollar versus every currency.

Tail risk of Brexit may also cause the spikes in demand for GPB downside (puts) over USD post risk event as well.

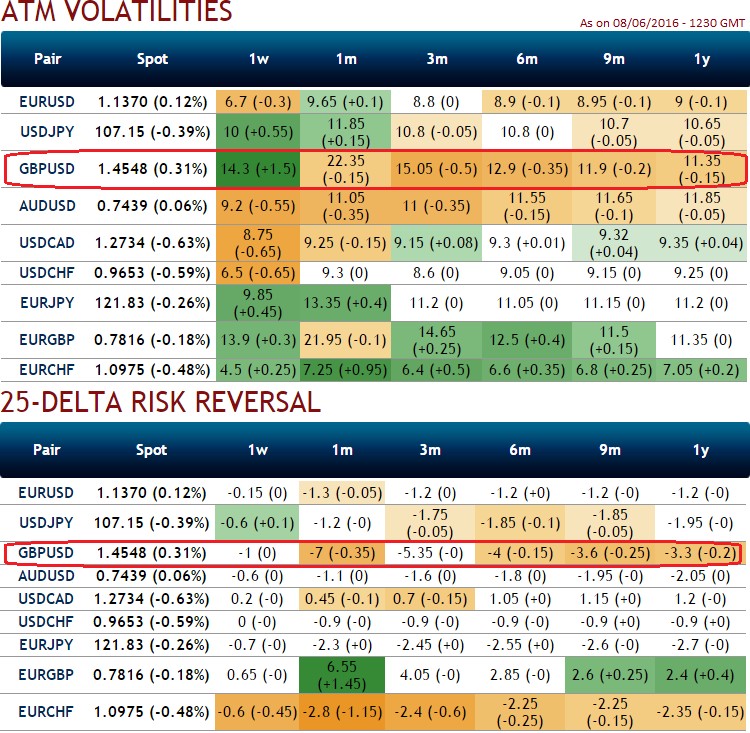

Subsequently, the implied volatility is at peaks, widening the corresponding break-even levels significantly.

Risk reversals: Please be noted that the demand for GBP puts/USD calls have spiked audaciously ahead of UK referendum. The downside risks could be seen even in the long run as you can observe hedging arrangements for downside risks between 3 months to 1-year tenors.

We, therefore, favor the use of forwards also to reduce short-term GBP exposure hedge GBP exposure using forwards.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close