The implied volatility of ATM contracts for 1M-3M tenors of EURUSD is flashing at around 12.45%.

Not only should the risk premium in the FX market fall, but the environment will not support the emergence of new trends. In particular, we expect EURUSD to stay restrained within the large 1.05-1.14 range holding from last couple months (more than a year to be precise).

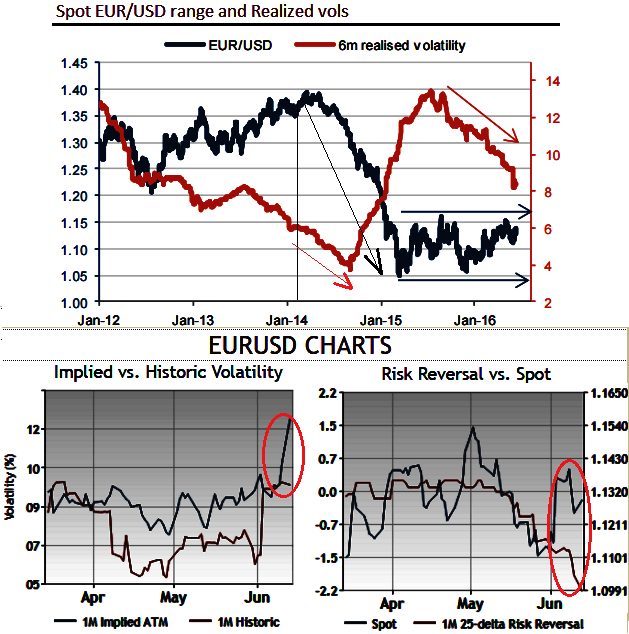

Volatility peaked during the euro fall that began in 2014, but though the range was relatively turbulent initially, EUR/USD realised volatility is now going down (See above graph), does it prevail further is the mystifying question here.

Subsequently, you can probably anticipate the realised volatility is likely to continue falling and implied should follow in the coming months.

Moreover, as and when you get to see the considerable divergence between spot curves and risk reversal curve for 1m period there has been the steep slump to fill in the gap between this divergence.

Well, it would be a smart approach for risk averse to minimize long trades in a less volatile range is what we are trying to convey.

The market can’t keep buying volatility in a trendless market and with limited expected central banks shifts.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings