Anyone who had wondered what had caused MXN weakness over the past few weeks received a clear answer last night. After Hillary Clinton clearly decided the first TV debate in her favour according to independent observers the peso appreciated by more than 1.5% against USD. For Mexico in particular, the election of the unpredictable property tycoon (who inherited the company from his father) would entail considerable risks.

This would at least entail the possibility that Trump would implement some of his half-baked ideas which would ruin the economic relations between the two countries. That has become a little less likely for the time being.

However, trade in the peso will nonetheless remain volatile until the elections on 8th November and the currency will come under repeated pressure every time the Trump-positive news is reported.

OTC outlook:

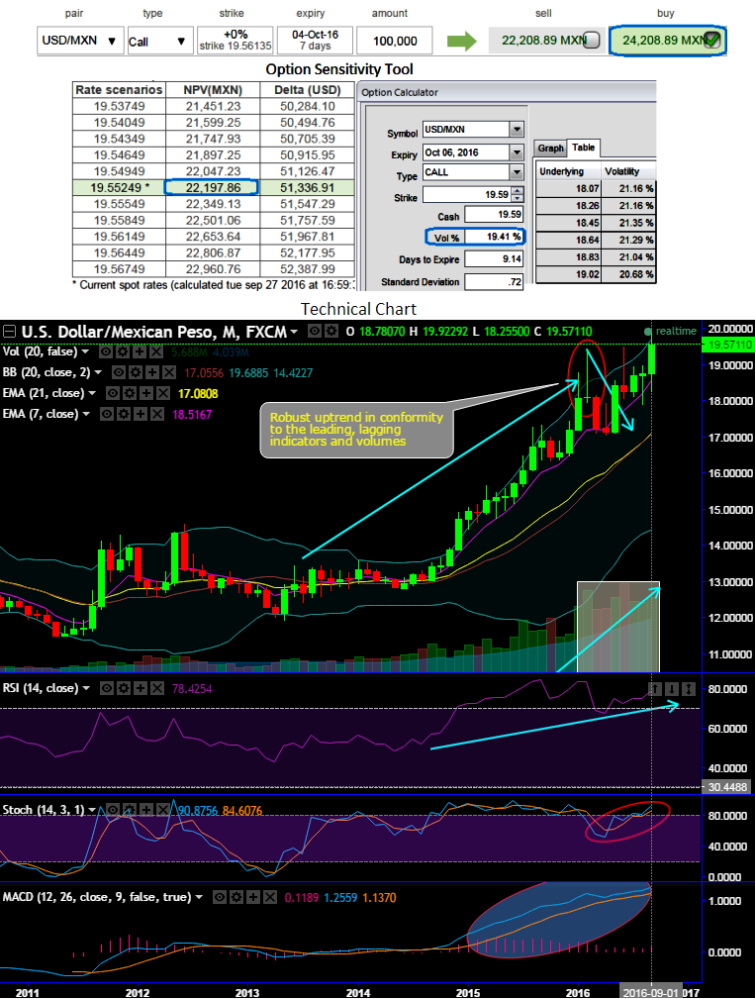

As you can make out 1w ATM calls have been priced just a tad below 9%.

While ATM IVs of this timeframe are spiking crazily at 19.41% and standard deviation at 0.72.

We think, although Mexican currency is attempting to recover in its prices, the above stated US election news and Fed’s hiking expectations during Christmas in addition, engulf with the uncertainties.

Technically, the major trend of this pair has undoubtedly been bull trend with both leading and lagging indicators converging to the rise in price (consistent price gains from last two years from the lows of 12.8185 to the current 19.5610 levels. Mammoth volumes are formed in the recent months also. So, we reckon the ongoing price declines are just deemed as profit booking by the speculators and the trend is likely to extend further.

The robust uptrend and higher IVs would mean the market thinks the price has huge potential for large movement in the upward direction.

Hence, contemplating all these factors, we recommend deploying underpriced ATM calls in any option strategy that would likely mitigate further upside risk in the months to come.