OTC outlook:

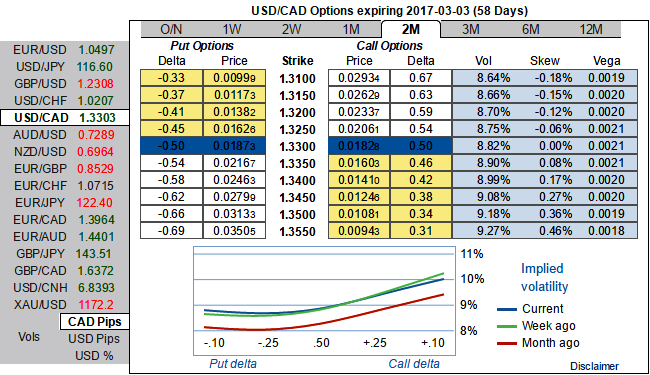

As you could observe the risk reversal flashes across all tenors, although we see neutral changes to the bullish risk sentiments, as a result, CAD seems to be gaining in next 2 months tenor on recent OPEC’s announcements, but on the contrary, USD’s robustness seems more attractive than CAD on account of series of significant events such as the Trump’s oath taking ceremony is nearing and on the Fed’s chances of hiking in 2017 can certainly not be disregarded.

Moreover, all these factors are discounted in FX option market. You could make out this in mounting risk sentiments as you could see the positively skewed IVs in OTM call strikes.

Well, these positive skews in 2m implied volatilities suggest RKO calls both on hedging as well as speculative grounds, the USDCAD 2-3m skew has been well bid with Trump progresses in the beginning months to come, lifting it to its highest level since June 2015.

In a broader perspective, USDCAD is stuck between 1.3080 and 1.3588 levels. The bearish rout is on cards in short run on any break below supports at 1.3280 levels, but no dramatic slumps.

We reckon the above fundamentals seem to be reasonably addressed by hedging participants, hence, we advocate below option strategy to mitigate risks on either way with cost effectiveness.

Hedging Framework:

Strategy: 2m 3-Way Diagonal Straddle versus OTM Put

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Let’s glance on sensitivity tool for 2m IV skews would signify the interests of OTM call strikes that would mean the ATM calls higher likelihood of expiring in-the-money, so writing overpriced OTM puts would be a smart move to reduce hedging cost.

The execution:

Go long in USDCAD 1M at the money -0.49 delta put, and go long 2M at the money +0.51 delta call and simultaneously, Short 2W (1%) out of the money put.

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty