A Fed rate hike in H2 16 and rising expectations ahead of it are expected to support USD/CAD from monetary divergence.

An expected plateauing of the oil price trend going forward also eliminates what has been one of the key factors behind CAD strength in the first half of the year. But CAD offers good long-term value and investors should look to fade any sustained weakness in coming months.

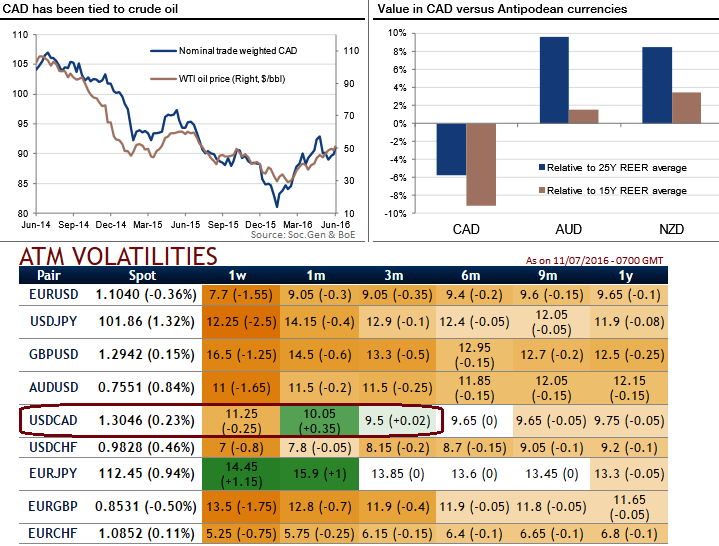

The Canadian dollar’s direction has been heavily influenced by crude oil prices in recent quarters (see above graph). So long as the recent lows in oil prices hold, there is room for CAD to outperform other commodity currencies in H2 16.

It certainly offers better value and is less exposed to China than AUD or NZD (see above graph).

Nonetheless, USD/CAD is unlikely to drop below 1.25 unless oil prices can rally durably beyond $60/bbl, which is not our baseline scenario.

In FX OTC, 1w ATM IVs of this pair is trading at 11.25% and at 9.5% in next 3m tenors with reduced bullish hedging sentiments.

As a result, contemplating above fundamental reasoning we would like to recommend below hedging strategy that uses Fx options with reduced cost and monitors both upswings and downswings.

The long put ladder or bear put ladder is a limited return with unlimited risk strategy in options trading that is employed when the options trader ponders over that the underlying spot FX of USDCAD would experience little volatility.

To execute this strategy, the options trader goes long in an in-the-money put, shorts an at-the-money put and shorts another lower strike out-of-the-money put of the same expiration date.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate