We’ve been urging for gold price resurgence ever since we spotted out a hammer pattern candle at 1243.54 levels on 8th of this month (when we advised a technical call on XAUUSD).

For more reading on our previous call, please go through below web-link:

Well, for now the yellow metal hits 22months highs at 1313.37 levels, dropping back to halt at the current 1303.46 levels.

Meanwhile, on the Comex division of NYME, gold futures surged above the $1,313-level an ounce to trade at the highest level since August 2014 as bullion speculators pushed back expectations for the next U.S. rate hike. While spot gold has broken the crucial resistance at 1294.50 levels.

Safe-haven demand strengthened after all central banks’ monetary policy seasons went unchanged to hold their rates unchanged, defying market expectations for additional monetary easing would divulge the fears of Brexit and global market slowdown.

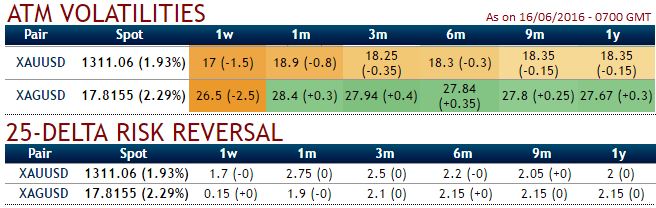

The implied volatilities of 1W XAU/USD ATM contracts have faded a bit 17% and 18.9% for 1m tenors.

While, risk reversals are still signalling upside risks with 1w bullish neutral, considering these aspects in bullion markets we think the opportunity lies in writing an OTM puts while formulating below strategy for gold's fluctuation at this juncture.

Hedging Framework:

3-Way Options straddle versus Put

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Bidding short term risk reversals with writing 1W OTM put contracts,

As stated above bullion market remains safe-haven demand especially strengthened after the major central banks maintenance of “Status Quo” that keeps us eyeing on shorting such expensive puts with shorter expiries. As a result, we capitalize on such beneficial instruments and deploy in our strategy.

How to execute:

Go long in XAU/USD 2M At the money delta put, Go long 4M at the money delta call and simultaneously, Short 2W (1%) out of the money put with positive theta.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings