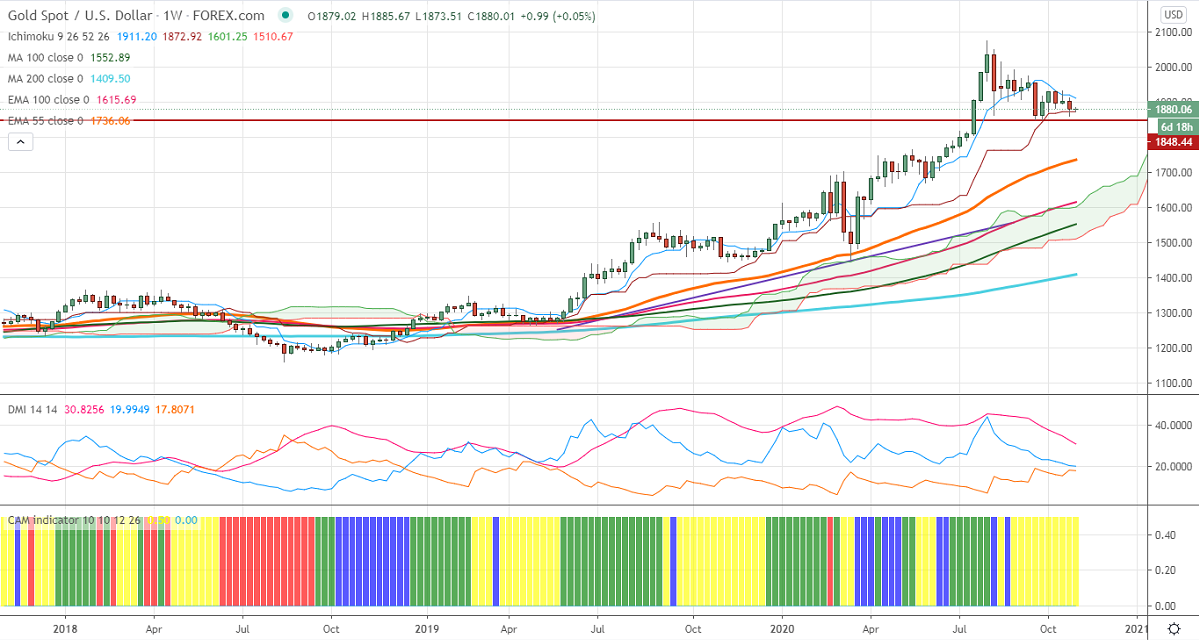

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1920

Kijun-Sen- $1872

Gold is trading flat as markets eye US Presidential elections for further direction. According to a CNN exit poll, the Democratic nominee led by 12 points over Republican President Donald Trump. US dollar index continues to trade higher and jumped nearly 140 pips the previous week. Any violation above 94.42 confirms bullish continuation. The US 10-year yield is holding above the 0.80% level and minor weakness only if it breaks 0.746%.

Economic data:

The US Q3 advance GDP rose to a record 33.1% annualized pace compared to forecast 32. %. The number of people who have applied for unemployment benefits declined to 751K compared to an estimate of 763K. . US personal income came at 0.9% vs forecast of 0.3%, while personal spending rose to 1.4% vs estimate of 1.0%. U.S Chicago PMI declined slightly to 61.1 vs 62.4 the previous month.

Technical:

In the Weekly chart, Gold is facing strong support near Kijun-Sen at $1872. Any break below will take the pair till $1860/$1848. On the higher side, near term resistance is around $1900 and any indicative break above that level will take the pair till $1910/$1921/$1933/$1950.

It is good to buy on dips around $1860-62 with SL around $1850 for the TP of $1920/$1933.