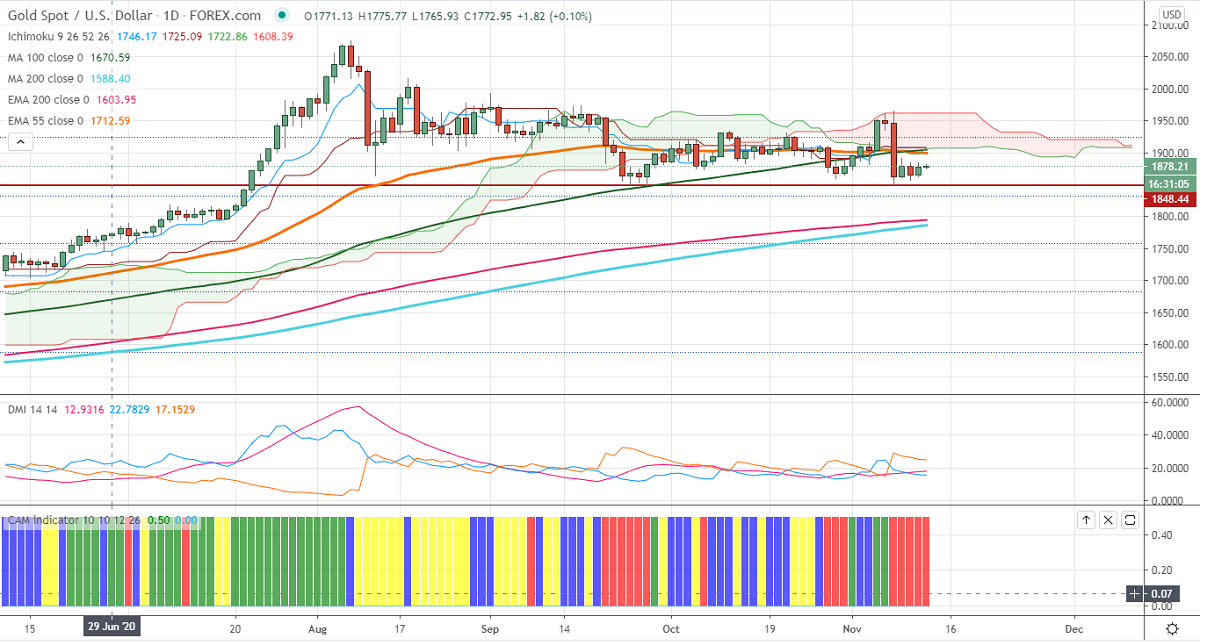

Ichimoku analysis (Daily chart)

Tenken-Sen- $1908.90

Kijun-Sen- $1908

Gold continues to trade in a narrow range after a major decline of more than $100. The COVID -19 vaccine optimism is putting pressure on yellow metal at higher levels. The dollar index is trading higher and any violation above 93.20 confirms bullish continuation. The US 10-year yield has lost more than 10% after hitting the highest level since March on vaccine news.

Technical:

In the daily chart, Gold is facing strong support at $1848 (Sep 24th low). Any break below will take the pair till $1832/$1800/$1781. On the higher side, near term resistance is around $1900 and any indicative break above that level will take till $1920/$1931/$1950.

It is good to sell on rallies around $1908-10 with SL around $1930 for the TP of $1848/$1832.