RBA monetary policy minutes have detailed record of the Reserve Bank Board's most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

The highlights in the RBA Board meeting minutes for December was that members had “agreed that it would be important to reassess the economic outlook in February 2020.” Whether that reassessment results in a rate cut will depend on whether the “gentle turning point” identified by the RBA is still evident. Weaker-than-expected Q3 GDP data and the fall in October retail sales challenge that judgment, though the Bank’s liaison program had pointed to “nominal year-ended sales growth [being] little changed in October and November.” Labour market data will likely be key for the RBA. Further weakness will mean labour market conditions can no longer be characterised as “broadly unchanged since earlier in the year” and will, in our view, be the catalyst for a rate cut in February.

The Aussie has bounced around 2 cents since early October, aided by a more positive tone on US-China trade talks and the unexpected Brexit breakthrough which has bolstered global risk appetite. AUD should remain supported near term but any trade in the 0.6950/0.7000 area is likely to attract substantial sellers. While supply interruptions could limit the recent fall in iron ore prices, coal prices remain near 3-year lows and we expect the US and China to reach only a very limited trade agreement in coming weeks. Moreover, the RBA does not want to encourage an A$ revival and pricing for another rate cut has been unwound too far, as we still expect a rate cut in Feb 2020.

Sell AUD vol risk premium as boom-bust cycles have become history with RBA ZLB in sight

From a volatility perspective, AUD has become a pale shadow of the uber-risk sensitive asset it used to be. The shift has been a number of years in the making, as the Australian business cycle has gradually decoupled from the global cycle in phases – initially led by the cliff edge in mining capex as the China-led commodity boom tailed off, and then due to strained household balance sheets and the constraints they imposed on domestic consumption.

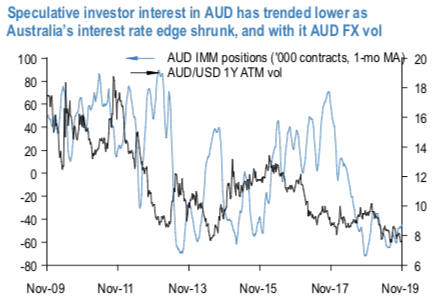

From a financial market standpoint, the 400 bp of RBA rate cuts alongside the secular slowdown in Australian growth this decade have resulted in a U-turn in investor interest in AUD; IMM positions have trended one way lower since the GFC and have now turned substantially short as the zero lower bound has come into sight (refer 1st chart). This has proven severely punitive for FX volatility – 1Y ATM vols have compressed 50% from their pre-RBA cycle norms – as the absence of healthy rate differentials and spec length has sharply dampened, if not entirely eliminated the boom- bust cycles of carry-related re- and de-leveraging that gave AUD vols their erstwhile potency.

As is the norm in option markets, the structural compression of rate carry and neutering of realized AUD volatility have been exacerbated by feedback loop from flow effects in option markets: leveraged participation in AUD weakness have taken the form of limited upside structures such as put spreads / digitals / reverse knock-outs etc.; Australian exporter hedging of foreign currency receivables has increasingly taken the form of risk-reversal selling; and yield-enhancing Japanese Uridashi structures that used to be a major source of negative convexity for FX option dealers in AUDJPY have increasingly migrated to higher-yielding EM currencies in recent years. The fallout of these flow shifts is that negative vol / convexity “holes” on dealer books have become conspicuously absent of late, and there is little or no scramble to cover short gamma/vega risk in spot sell-offs that used to be the case in the past.

As a result, there has been a sharp de-coupling of AUD vol returns from spot trends in recent years, evidenced by the surge in short delta-hedged straddle P/Ls since 2Q’18 even as spot experienced a 17% drawdown (refer 2nd chart). In a world starved of vol risk premium, selling AUDUSD risk-reversals systematically to monetize this potentially permanent spot-vol decoupling can be a durable source of alpha. Courtesy: JPM

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch