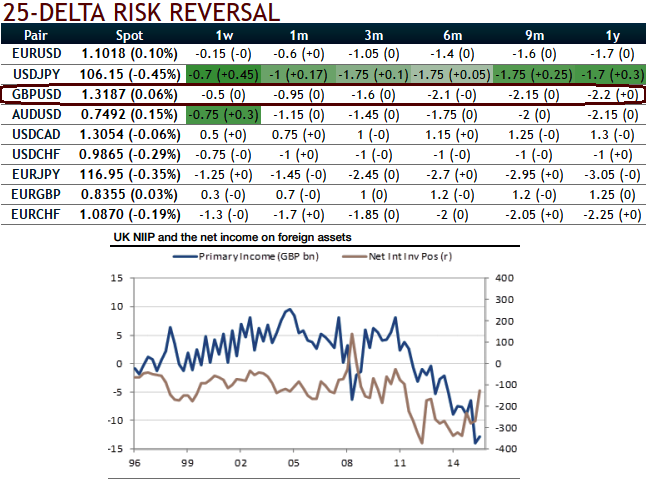

Delta risk reversals of GBPUSD: From the nutshell showing delta risk reversals, we understand that GBPUSD has been one of the most expensive pairs to be hedged for downside risks as it indicates puts have been relatively costlier over calls. As it showed the 2nd highest negative values which indicate downside risks of spot FX is anticipated and hedging for such risks is relatively more expensive.

The OTC options market appeared to be more balanced on the direction for the pair over the 1m to 1y time horizon as hedgers have been cautious on long-term downtrend that has lasted since mid-April 2013 and as a result delta risk reversal for GBPUSD was turning into negative, while the UK current account balance data go back to 1946. The annual deficit (just over £100bn in 2015) didn’t get above £1bn in a single year until 1973, so we reckon the pre-1946 story can be largely ignored. Since 1946, the cumulative deficit is £881bn, and it’s getting bigger and bigger.

This ought to equate roughly to the country’s net international investment position (NIIP), that is definitely not the case. This, in turn, reflects the fact that valuation shifts affect the country’s NIIP, rather than cumulative flows. In theory, running deficits will make the NIIP deteriorate until the current account returns to surplus, but since end-2014, the net international investment position has actually improved by nearly £200bn to a level of - £128bn.

This isn’t the only part of the UK balance of payments that is, at first blush, confusing. The net asset position has improved, yet the income on foreign assets has deteriorated. The UK’s net foreign assets are in the hands of a small number of large multi-national companies, many in the resources sector.

The income they earn on overseas investments has fallen because too many are in sectors like energy, where prices have fallen significantly. That worsens the current account balance. But if those weak earnings simply discourage investment in more capacity in these industries, a lower dividend flowing home would be offset by reduced investment overseas in the financial account.

Hence, we think the foreign trade bills in pounds denomination are so needy to be hedged for downside risks and so is evidence in OTC hedging arrangements.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts