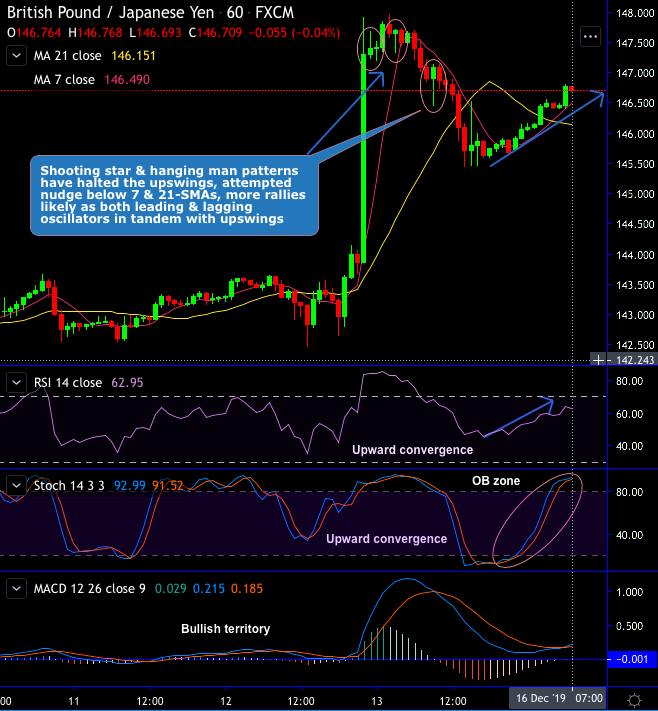

Of-late GBPJPY minor trend has been regaining from its losses, the pair has bounced back from the lows of 126.541 levels to the recent highs of 147.954 levels. But the shooting star and hanging man pattern candles have occurred at the peaks of rallies, at 147.403 and 147.699 levels respectively. These bearish patterns have stalled the bull-swings and attempted to nudge the prices back below 7 & 21-SMAs (refer intraday 1H chart). But for now, the interim rallies likely upon breakout above 21-EMAs.

On a broader perspective, the major downtrend still remains intact as the trend is consolidating and the consolidation phase has just retraced 23.6% Fibonacci levels (refer monthly chart). The further interim upswings likely as the consolidation phase regains at the inverse saucer support line but these rallies have to clear stiff resistances.

Major resistance zone is – 149.651, 151.945 and 156.929 levels. The bulls should breakout these pivotal levels for the major trend to be deemed as the reversal.

Trade tips: At spot reference: 146.661 levels, contemplating above technical rationale, one can execute tunnel options spreads using upper strikes at 147.978 and lower strikes at 143.681 levels. Such exotic option likely to cap upside movement and favor selling sentiments and fetch leveraged yields as compared to spot.

Alternatively, ahead of BoE monetary policy that is scheduled for this week, with UK PMI numbers, shorting futures of mid-month tenors are advocated with a view of arresting the resumption of major downtrend. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.