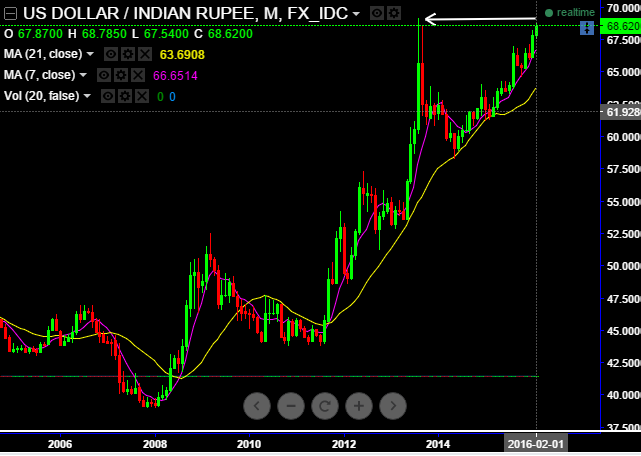

The Indian rupee rout has been nonstop and one of the two main underperforming currencies in Asian currencies so far this year.

It is the 2nd weakest and down 3.7% vs USD year-to-date, behind KRW's -5.3%.

Volatility in rupee continued as it pared early gains to rule almost flat, marginally up by one paise to 68.83, during afternoon deals on demand from banks and exporters amid heightened uncertainties of union budget of India and US rate hikes in 2016.

USD-INR is approaching the all time high of 69.22 in August 2013 at the height of the twin deficit concerns in Asia where INR and IDR were badly hit.

India recorded a USD 7639 million trade deficit in January of 2016, lower than a USD 7872 million gap a year earlier and reaching the smallest shortfall since February of 2015.

Exports chop down to 13.6% to USD 21,080 million, the 14th straight month of decline, as non-petroleum exports declined by 10.55% to USD 19,116 million.

Imports dropped 11% YoY basis to USD 28,710 million, following a 3.88% fall in the previous month. While oil purchases slumped 39%, gold imports surged 85.2%.

Driving forces of INR's weakness:

Weak export growth - prompting calls for RBI to continue with monetary easing, including both further rate cuts and a weakening bias for INR.

Net outflows - Notably, the net foreign equity investment outflows from Indian capital market amounted to USD2.4bn year-to-date (YTD) vs the net inflows of USD3.3bn in 2015. For debt investment, net outflows stood at USD605mln YTD vs a net inflows of USD7.6bn in 2015.

For INR, a gradual and orderly depreciation is seen as a cushioning factor for the economy as it will help to support export revenue, rural income, and private consumption. The next key event to watch is the Union Budget on 29 February.

We expect the government to stick to its fiscal consolidation program to help shore up investor sentiment. The fiscal deficit target for FY2016/2017 is seen around 3.7% of GDP, slightly higher than the original target of 3.5% and the medium term target of 3% to be pushed out by a year or so.

FxWirePro: Foreign investments, trade terms propel USD/INR to inch up all time highs at 69.22 again ahead union budget

Friday, February 26, 2016 11:36 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate