As you could make out from the IV nutshell of ATM contracts of 6m tenors, the implied volatilities of ATM contracts of this the pair are flashing at around 9.85% for 1w expiries and hovering above 11% across longer tenors.

While the delta risk reversals negative ticks in 6m tenors signify the hedging positions are well equipped for extreme downside risks over the longer period of time.

We already called for EURUSD downside one month ago when it was trading at 1.10 levels.

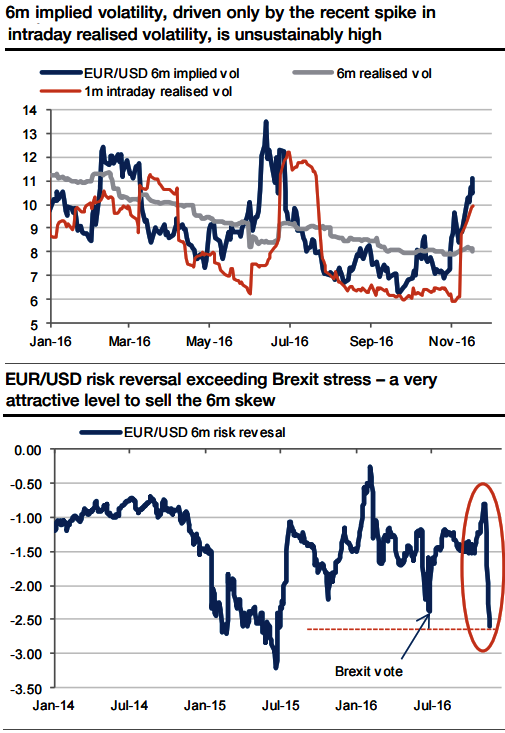

A lower EURUSD should lift volatility, but we would not buy it from there. We think EURUSD 6m implied volatility has been fairly bid, rising above 11 for the first time since the Brexit-vote stress, and the volatility risk premium is probably excessive.

It is trading more than 3 volatility points above the 6m realized volatility, and the rise is only due to the recent spike in intraday realized volatility triggered by the US election.

Only repeated and frequent massive volatility spikes could really sustain 6m volatility at such a level, meaning that it is too high (refer 1st graph).

The best prediction is that breaking parity would be a move of large but uncertain amplitude. An option trade should, therefore, deliver a constant pay-off over a wide range of bearish scenarios without exposure to unlimited downside risk.

The 6m expiry captures the result of the French presidential election on 7th May 2017.

EURUSD 6m implied volatility is rising above 11 for the first time since the Brexit-vote stress. It is, however, trading more than 3 volatility points above the 6m realized volatility, and the rise is only due to the recent spike in intraday realized volatility triggered by the US election.

This is also a very attractive level to benefit from the very elevated 6m skew, also exceeding the level reached during the Brexit-vote stress (refer 2nd graph), enabling the generation of significant downside leverage.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022