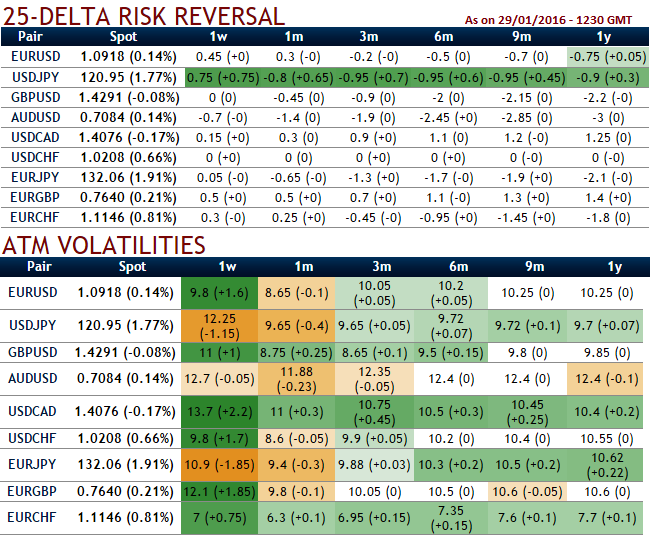

The steady surge in negative delta risk reversal would mean the OTC FX gushes towards downside risk, subsequently, puts are relatively costlier than calls as bearish momentum intensified in a long run.

While IVs are huge (1w-10.9%), and it has remained above 9 but gradually increasing from 3m-1y expiries that would mean that EUR/JPY's downtrend is intact in long run. But OTC volume index has not shown convergence with this indication.

Our recent observation on the IV factor of ATM contracts with 1w expiry of Yen denominated currency crosses tops the list and same is the case with risk reversal table for highest hedging activities eyeing downside risks.

Although we may see a little spike in prices in next week or so, as the hedging activities of downside risks are mounting up, and volatility smiles most frequently tells that traders are willing to pay higher implied volatility prices as the ATM strike price of put grows aggressively in the money.

We had advocated a "put ratio back spreads" a week ago in which ITM shorts were recommended by now those shorts must have certainly derived a handsome gains in the form of receipt of premiums, for now the recommendation is to use reducing vols to stay calm with existing longs, if possible load up with an extra-long on ATM put with 1M expiry in the strategy.

One can only enjoy the difference in the premiums but be mindful of the fact that the paid premium would not be reimbursed if the option is not exercised during the period covered by the transaction.

The opportunity to profit from exchange rate fluctuations applies only up to a certain limit as agreed at the time of entering into the transaction.

For now, with the current spot FX is trading at 131.601, fresh short build up positions should be avoided, longs in 2 lots of 1M ATM -0.49 delta put should be maintained as a means of hedging instruments.

In case of early termination of the transaction, the customer may incur expenses or earn income, the size of which depends on forex market situation then prevailing.

FxWirePro: EUR/JPY risk reversals indicate downside risks in next 1 month – shorts in PRBS fetch certain yields, long’s functionality underway

Monday, February 1, 2016 7:04 AM UTC

Editor's Picks

- Market Data

Most Popular