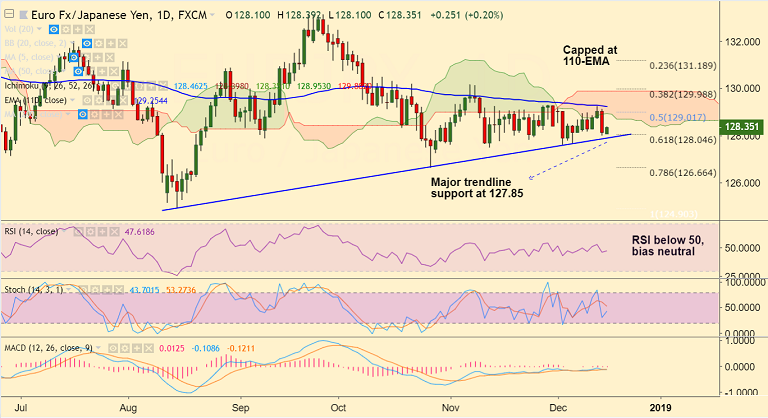

EUR/JPY chart on Trading View used for analysis

- EUR/JPY is trading at 128.33, up 0.14% on the day at the time of writing.

- The pair has been rejected at 110-EMA and has seen a steep fall on Friday's trade as poor data overshadowed easing concerns regarding Italy's budget.

- A below-forecast China's retail sales, industrial production data amplified fears of a global growth slowdown.

- Further, the dismal Eurozone services and manufacturing surveys further added to the malaise.

- On the data calendar today we have the Eurozone trade balance and the November CPI, scheduled for release at 10:00 GMT.

- Europe's CPI reading early today could see broader markets take a turn for the risk-averse if inflation measures confirm traders' fears about an economic slowdown.

- The pair finds major support at 127.85 (Trendline), break below could see further weakness. Scope then for test of 78.6% Fib at 126.66.

- On the flipside, immediate resistance is seen at 5-DMA at 128.51. Bearish invalidation only on decisive breakout at 110-EMA.

Support levels - 128.04 (61.8% Fib), 127.85 (trendline), 127.61 (Dec 4 low)

Resistance levels - 128.51 (5-DMA), 128.90( 55-EMA), 129

Recommendation: Stay short on break below major trendline support at 127.85, target 127.60/ 127/126.70.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data