FX OTC market has been reluctant for Swiss franc despite SNB’s monetary policy tomorrow.

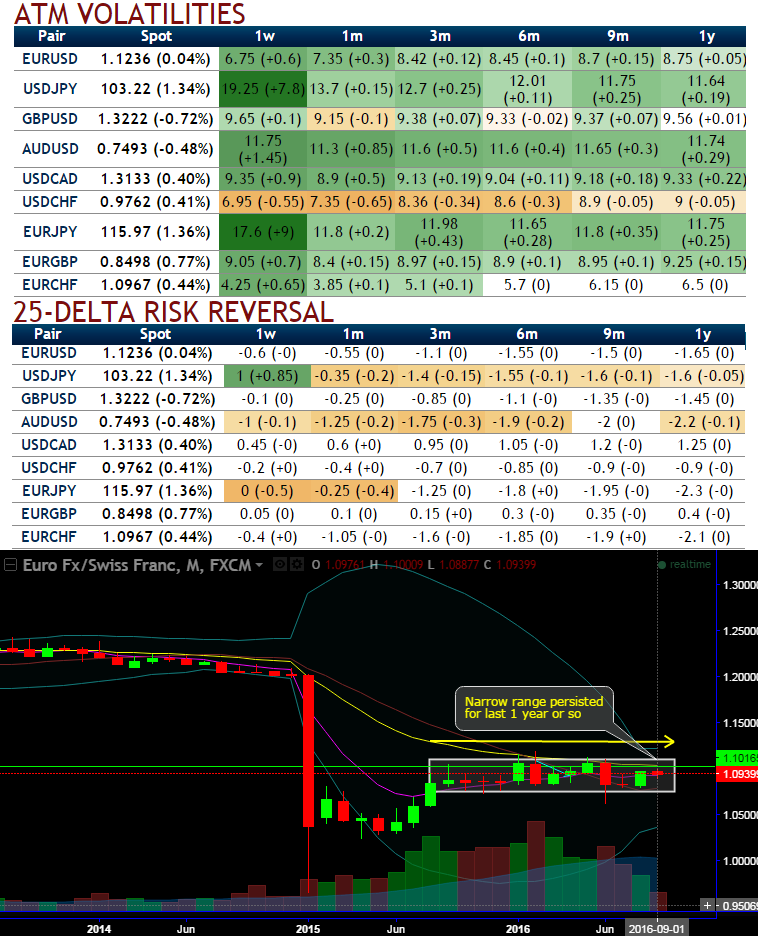

Please be informed that the implied volatilities of EURCHF ATM contracts of all expiries have been the least among G10 currency segment.

The Swiss central bank likely to maintain status quo in its monetary policy as the Brexit referendum and recent ECB action has not led to considerable pressure on the Swiss franc even if the foreign exchange interventions have continued with reserves increasing in August to CHF 626.6 billion.

While, the delta risk of reversal of the pair has also not been indicating any dramatic shoot up nor any slumps, but seems to be one of the pairs to be hedged for downside risks as it indicates puts have been relatively costlier.

Option-trade recommendations:

One can prefer iron condor on the lower IV circumstances. To execute the strategy, the options trader buys a lower strike OTM put, sells a middle strike ATM put, sells a middle strike at-the-money call and buys another higher strike OTM call. This results in a net credit to put on the trade.

Time frame: 7 to 10 days

Overview: Slightly bearish in the short term but sideways in the medium term.

Rationale: EURCHF’s range bound pattern is still persisting during lower IV situations but some bearish candles are indicating slight weakness on both weekly and monthly charts, (Ranging between upper strikes 1.1128 and lower strikes at around 1.0725 levels.

We could still foresee range bounded trend to persist in near future but little weakness on weekly charts is puzzling this pair to drag southward targets but very much within above stated range.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady