The CAD is quietly consolidating within an incredibly tight range and trading just below last week’s 2019 high. Fundamentals remain supportive and the CAD continues to trade well below our estimated equilibrium based on interest rate differentials and oil prices. Near-term domestic risk is limited to today’s housing starts and building permits ahead of Wednesday’s BoC policy decision (widely anticipated hold) and MPR forecast update. Canadian housing starts and building permits are lined up for the announcement. Canadian municipalities issued a record CAD 9.3 billion worth of building permits in April 2019, up 14.7 percent from the previous month while markets had expected a smaller 1.3 percent rise.

Recent domestic releases have confirmed the BoC’s expectations for recovery following the Q4/Q1 soft patch. Messaging on the ‘degree of accommodation’ is likely to remain unchanged as a result of global trade policy uncertainty, however. We remain bullish CAD in the short-run and look for continued strength in the minor trend.

However, today’s data announcement comes ahead of next week’s Bank of Canada meeting. Rates are expected to remain unchanged, so Governor Poloz’s update and forward guidance will be key.

On the flip side, the euro may have been able to stabilize somewhat in the last few days, but it is still not in good shape. The recent euro weakness is due to the expectations of ECB easing monetary policy considerably. The question that matters most is when and how much will it deliver? In this context, Governing Council member Benoit yesterday rekindled speculation that the ECB could revive its QE program. If it were to actually use this instrument, it would send a strong signal.

After all, by now everyone should be aware that the ECB would move on thin legal ice with further extensive bond purchases. But would it really be willing to go so far just to reach its inflation target? At least our ECB experts consider this questionable. However, this does not necessarily mean that the ECB will disappoint the market in its expectations. It only speaks for the fact that it is more likely to turn the interest rate wheel more forcefully than the majority of market participants currently expect. This should be enough for noteworthy euro weakness - at the very least in the short term.

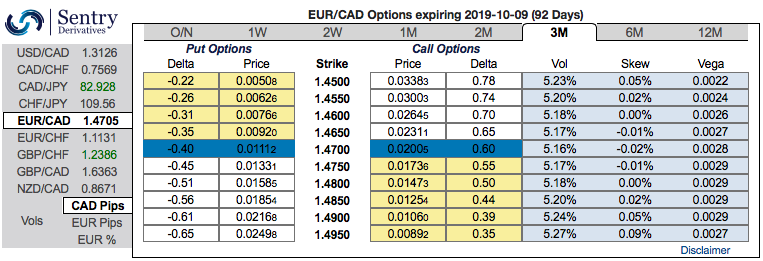

Perhaps because of the comatose state of currency markets at present, CAD option risk premia appear oblivious to the fallout of this high stakes standoff. EURCAD risk- reversals, in particular, appear too complacently priced: at zero across the curve, they are well discounted to already low USDCAD risk-reversals (3M 0.35, 1Y 0.7), and under-priced relative to even tepid recent realized spot- vol correlations (SABR implied 6M spot-vol corr. in EURCAD r/r 1% vs. trailing 1-mo spot-vol corr ~15%).

While positively skewed IVs of EURCAD has also been stretched on either side, both OTM Calls and OTM puts are on equal demand.

Hence, 3-way options straddle seems to be the most suitable strategy for EURCAD contemplating some OTC sentiments and geopolitical aspects.

You see any fresh positive bids in EURCAD risk reversals to the prevailing condition, it should not be perceived as the bearish scenario changer, nor uptrend continuation. Instead, below options strategy could be deployed amid such topsy-turvy outlook.

Options strategy: Keeping above seesaw geopolitical and hedging sentiments under consideration, 3-way straddles versus ITM calls are advocated, the strategy comprises of at the money +0.51 delta call and at the money -0.49 delta put options of 1m tenors, simultaneously, short ITM calls of 1w tenors. The strategy could be executed at net debit but with a reduced trading cost.

Hence, on hedging as well as trading grounds, initiate above positions with a view of arresting potential FX risks on either side but slightly favoring short-term bearish risks.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields