We’ve constantly been alerting bearish pressure ever since the occurrence of shooting star pattern at the peaks in last October.

For more readings on our previous technicals write ups please follow below weblinks:

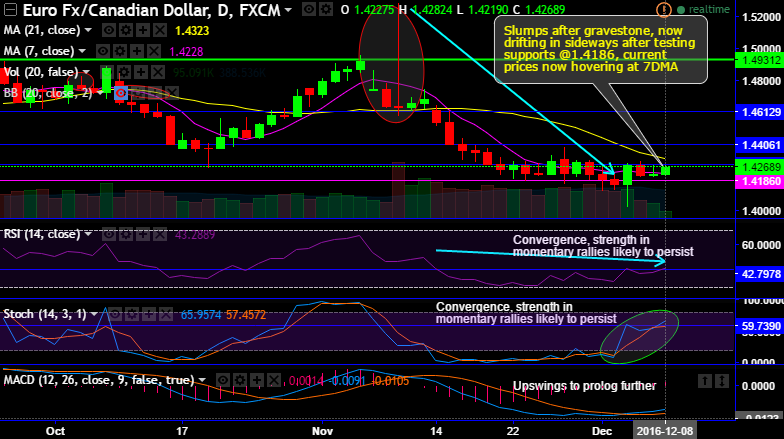

After those indications, the pair has slid below strong support at 1.4186 levels as anticipated, rest is history, this wee it has shown a slight recovery.

The prevailing rallies seem to be panicky but if you look at the major trend it should not be troublesome for long term bears.

Rallies now attempt to break a stiff resistance of 1.43 levels on daily plotting, whereas technical indicators signal more dips on failure swings, any break above has more upside potential as well.

RSI on weekly has been evidencing the downward convergence that signals the strength in the bearish trend.

While lagging indicators on this timeframe indicate more bearish journey.

MACD with bearish crossover at zero levels implies that the downswings to prolong further. Additionally, 21SMA crosses-over 7SMA which is again a bearish signal.

Massive slumps after gravestone, now drifting in sideways after testing supports @1.4186, current prices now hovering at 7DMA, a decisive break or failure swings at 1.43 would be cautiously watched.

At this juncture, we see speculative opportunities in double touch binary options, this option trade is useful for intraday traders who believe the price of an underlying spot FX would undergo a large price movement, but who are unsure of the direction.

A trader can use a double touch option with barriers at 1.4282 and 1.4225 to capitalize on this outlook.

Some traders view this type of exotic option as being like a straddle position since the trader stands to benefit on a calculated price movement up or down in both scenarios.