This focus summarizes the main features of EMEA EM’s export market. For each country in the region, the top three exporting destinations by export value has been listed (refer above table) and the top three exported products (in the 2nd table). Emerging Europe’s largest export exposure is to the Eurozone.

Germany, in particular, accounts for an average 27% of the CE-4 exports and is the largest export partner of Turkey and Bulgaria. For Eastern European and Balkan countries, namely Kazakhstan, Bulgaria, Croatia, Serbia, and Romania, Italy is also a major trading partner.

Outside emerging Europe, links are closer to China and the US. China is one of the top three trading partners of Kazakhstan, Saudi Arabia, Russia, Ukraine, and South Africa, through commodity exports. Israel has particularly high exposure to the US due to a free trade agreement, and Nigeria and South Africa also enjoy strong ties to the US.

The composition of products exported across EMEA EM varies, with strong similarities in CEE. The CE-4 and Serbia share the same top three exports, vehicles, machinery, and electrical machinery, in varying order. Such goods account for, on average, 45% of the countries’ merchandise exports. Turkey and Croatia also have overlap in these products. The commodity producers, Nigeria, Saudi Arabia, Kazakhstan, and Russia, have the least diverse exports.

“On a DXY basis, there is very little going on for the dollar from current levels as we are seeing the continuation of very easy financial conditions with accompanying fiscal stimulus,” said Timothy Graf, head of macro strategy for EMEA at State Street Global Markets referring to the dollar’s trade-weighted basket against its rivals by its popular acronym.

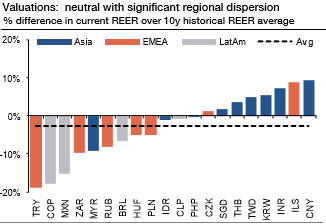

Positive global risk appetite bails out the favored shorts for now. With EURUSD staging a recovery above 1.20, commodity prices rising and inflows starting the year on a strong note following some pent-up demand over the yearend, EM FX has been broadly supported. This has lifted even the poor idiosyncratic stories in our region. For instance, USDTRY is down 5% since end-November, even as inflation and the current account dynamic remain highly unfavorable and the central bank failed to hike sufficiently in December to contain imbalances.

Outright trades:

Long 6m EURRON forwards

Short EURCZK, we kept saying to hold short in EURCZK forwards, now reiterate roll on these derivatives contracts for Mar’2018 tenors.

We revised our end-2017 EURCZK forecast up to 25.219 (earlier target have been achieved 26.25), given the lower than expected volatility of the currency post floor removal.

Long ILS vs basket (0.5 EUR, 0.5 USD)

3m USDTRY put up-and-in, short USDTRY (post fall-out from Reza Zarrab trial).

While we remain UW FX and hold previously advocated outright USDTRY ATM +0.51 delta call which is performing well as per our expectations (spot reference: 3.7725) of 3m tenors. Hold this derivative contract on both hedging as well as trading grounds, please observe payoff structure that flies exponentially as the underlying spot FX keeps spiking northwards (refer above nutshell showing payoff structure).

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty