Amid minor price drops in the dollar index, the markets continued to run with a positive view of the looming economic policies from Trump. In a thin news session, US equities made fresh record highs, and the US dollar and interest rates rose.

Fed fund futures firmed 1bp, pricing the chances of a March meeting hike at around 25% and the June meeting at 100%.

Federal Reserve chairperson Janet Yellen possibly wouldn’t drip dense insinuations on the timing of the next interest-rate increase when she speaks to Congress this week, but expect her to defend post-crisis banking rules the Trump administration has sworn to undo.

Yellen’s semi-annual testimony to lawmakers in Washington on Tuesday and Wednesday will be her first such performance since Donald Trump became president, a shift in power that may expose the U.S. central bank to deep changes favored by some in his Republican party, which remains in control of both houses of Congress. The hearings could also serve to shed light on where the Senate Banking Committee’s new chair, Idaho Republican Michael Crapo, stands on proposed changes to the central bank’s authority and structure.

On monetary policy, Yellen is expected to keep the Fed’s options open ahead of its next policy meeting. While few investors anticipate a move when officials gather in mid-March, several Fed policy makers have argued a rate increase should not be ruled out.

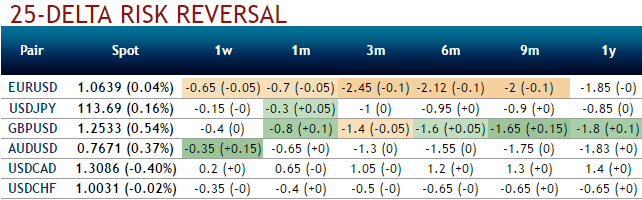

As a result of above hawkish notes by Federal Reserve chief, the bullish risk sentiments for dollar crosses remain intact in OTC markets. The bullish neutral risks reversals would imply that the further upside risks in dollar crosses need to be priced in. You could observe that the nutshell showing risk reversals of dollar crosses indicates the upside risks except for USDCHF.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings