As we anticipate a short term upswings are on the table but long term downtrend can also not be ruled out based on our technical reasoning in our previous article, we would like to position accurately and strategize using fairly priced options so as to match the trend.

For our previous articles on technical analysis, please refer the below link for more reading:

http://www.econotimes.com/FxWirePro-GBP-AUD-bears-travel-in-sloping-channel-confirms-long-term-downtrend-to-prolong-despite-interim-upswings-151998

Since, the pair is on verge of reversing the direction to the short term upswing approximately at around 2.0025 levels that is where it forms a consolidation pattern, such as a bottoming at channel base or in other words where the spot FX price action has become tighter and where volatility would shrink away in advance of a big move in either direction. Typically, we're looking for a pennant within the context of an upward trend.

After going through the above article on technical reasoning, we hope what the trend is intended to be at this juncture and if you compare the prevailing price of GBPAUD with the recent swings it would be more convincing.

Therefore, it's now the stage of tackling the situation after evaluating. For now, the pair has pretty much responded as per earlier analysis and it should drag near channel base and we could then foresee a price bounces at around 2.0025 levels in near term as the daily chart may pop up some buying interest that would result in some price recoveries from there onwards. but we maintain our long term bearish targets.

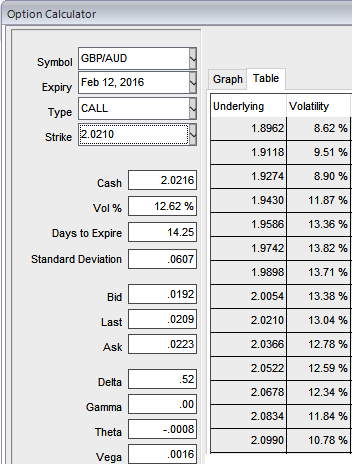

As a result, we recommend wait for another 3-4 trading days then build the portfolio with longs positions in 2 lots of 2W ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of 2W expiries.

Since, we anticipate upswings after 3-4 days, this GBPAUD option straps strategy should take care of both upswings and downswings, and yields handsome returns on the upside in short term.

Delta of far OTM options is very small which is why we've chosen ATM instrument on call. A 1 point movement in underling pair will not have much effect on the option premium.

Investors need to be optimistic that the volatility in the underlying pair will occur during the short lives of the options. Preferably, the movement will occur towards the leveraged side. If the hoped for price swing does occur, these strategies can be quite rewarding.

FxWirePro: Deploying GBP/AUD diagonal straps to serve both speculative and hedging objectives

Friday, January 29, 2016 9:06 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand