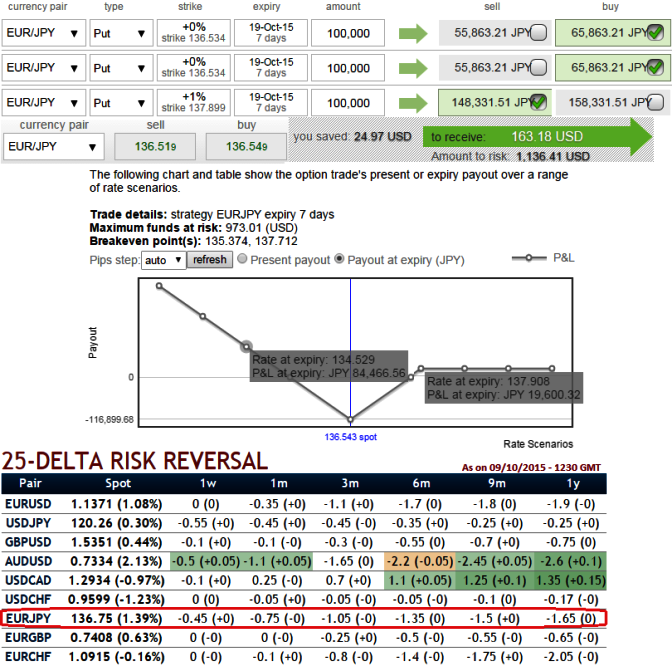

Please be informed that how delta risk reversal numbers are getting higher negative values gradually in a long run (flashing at 1.65% for 1 year expiries). Volatility smiles most frequently tells that traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.

The challenge now is determining which strikes you should use in this strategy. The broader the strike difference between short and long puts, the fewer puts you need to sell to cover the price of the long puts. But at the same time, the coverage of long-to-short is going to be more difficult in the event of assignment.

The current spot FX is trading at 136.555, we expect dips extending up to 133.372 levels in near terms. It is understood that bearish momentum is bolstering as we saw that from delta risk reversal table and technical indications. Hence, aggressive bears can initiate strategy using ATM puts.

Unlike a simple naked put, put backspreads have an extra long that has not only leveraging effects, a short option at a lower strike that caps your reward but also reduces the net cost of the trade. So, the recommendation for now is to add an extra long on put with 1W expiry to the existing debit put spreads.

With these narrow strike differences, the profit potential is greater, so that the ratio needed is also lower to profit on underlying movement. You want to take this trade if you think this pair can go lower, but not crash below 133.372 (the OTM shorts). Caution: If you think the pair is going to crash, you should be loading up on put buys in existing strategy. The total cost of the trade is going to be the difference between the prices of the two options.

Since the option you sell will always be lower on the skew curve it means you are getting a better deal on what you are selling compared to what you are buying. It makes this strategy a good one if the skew is running a little hot but EURJPY hasn't rolled over that much.

FxWirePro: Delta risk reversal suggests EUR/JPY ATM puts priced costlier – PRBS to reduce hedging cost

Monday, October 12, 2015 7:39 AM UTC

Editor's Picks

- Market Data

Most Popular