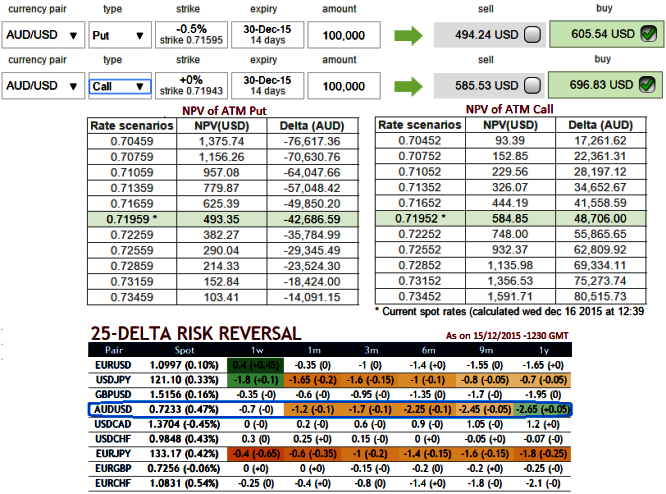

Overpriced puts moving in sync with delta risk reversals of AUDUSD: From the nutshell, 25-delta risk of reversals of AUDUSD the most expensive pair to be hedged for downside risks as it indicates puts have been overpriced.

As it showed the highest negative values indicate puts are more expensive than calls (downside protection is relatively more expensive).

You can observe ATM puts with 2w expiry are trading 22% more than NPV, while ATM calls at 19% above NPV.

As a result, AUD/USD has been in consistent supply when the PBoC came out and instigated what had been expected of them in as much of the poor performances of the economy of late.

Deep dive into Chinese reserves, we broke apart Q2 data to find it is likely China is a much larger holder of AUD assets than the average reserve manager.

Apart from today's Fed's monetary policy impact, if Chinese reserve drawdown accelerates, we would look for AUD to trade lower. But under our base case, we look for AUD/USD to end Q4 not far from current spot in Q4 (end-Q4 target 0.69).

After the brief upswings to 0.7385, the OTC options market appeared to be more balanced on the direction for the pair over the 1m to 1y time horizon as hedgers have been cautious on long term downtrend that has lasted since mid-April 2013 and as a result delta risk reversal for AUDUSD was turning into negative.

Considering the above aspects, we recommend deploying one touch binary puts in our strategy in order to extract leverage on extended profitability.

On speculative grounds, at current spot FX levels of 0.7205 one touch delta calls are recommended for targets of 25-30 pips (i.e. 0.7235 levels), the prime merits of such one touch option are high yields during high volatility plays.

Wider spreads indicate lack of liquidity, one can multiply return by twice, thrice or even pour returns exponentially.

The spreads for one touch AUD/USD options are constant time and barrier levels. Usually, such binary options for every change in 1 pip the relative change in option price 0.01% or even exponential at high implied volatility times.

FxWirePro: Delta risk reversal still signifies AUD/USD’s bearish trend but well poised OTC creates speculating choices

Wednesday, December 16, 2015 7:29 AM UTC

Editor's Picks

- Market Data

Most Popular