Precious metals underwent a major regime change in May, when gold sprang to life amid the May US/China trade outburst. 3M gold vols jumped 5vols and silver 10vols as spot moved up 15% and 25%, respectively.

Fundamentally, it is not expected that the gold and silver volatility environment in 2020 to be starkly different from that of the last 6 months. At 10.4vols, 3M gold implied is within a whisker of the levels from exactly a year ago, but we reckon it is unlikely for it to go into a long snoozer and back below 9 handle.

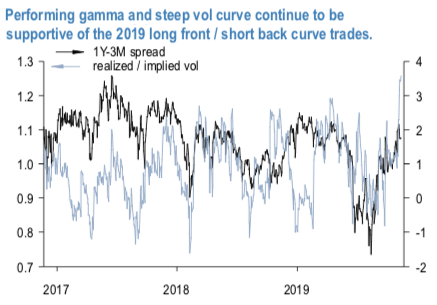

Currently, sentiment-supportive environment make a vega event unlikely (not considering the US 2020 election pricing for the moment). The risk is that lack of a catalyst constrains the spot and generates downside pressure on realized and implied vol. 3M implied vol could decline by another 1-2vol pts before hitting the multiyear low, though we see that scenario short lived. The performing gamma and steep vol curve (refer 1st chart) continue to be supportive of the 2019 long front / short back (long gamma vs short vega) curve trades.

We recommend: Vega neutral delta-hedged 4M straddle @10.8ch vs 12M XAU/USD strangle @12.7/13.7indic, which also provides exposure to the March 12th super Tuesday.

As pointed out below, wide premium on the wings (via the vol of vol parameter, 4th chart) supports buying ATM / selling OTM vols at present. The back tenor OTM calls at near the two decade high vs. the ATM vols (refer 2nd chart) and the historically strong performance are both supportive of ratio call spreads (refer 1stchart) as a hedged expression of fading rich skew that should come under pressure if our fundamental analysts’ view of a contained gold spot realizes.

Buy delta-hedged 1Y XAUUSD 1*2 ATM/25D strikes ratio call spread @12.2ch vs 15.25/16.25indic, vega notionals.

Since the Brexit referendum and the 2016 US election, the two major upsets during the turbulent 2016, FX option markets have been sensitive on the issue of political event risk premium. The upcoming 2020 US election pricing is gearing to be one of the most eventful in history.

A notable uptick in FX options pricing of the risk came at the 13-month mark before election day, well ahead of any of the previous elections, and the pricing had broadly kept going higher as the liquid 1Y tenor rolled on the event risk. G10 vols gained 8pts in the overnight, while the election risk premium, measured as overnight/ATM vol ratio, has jumped from 3X to 4.5X, signaling rapidly shrinking opportunities for owning the election risk.

Interestingly, we find the gold election overnights heavily lagging (refer 3rd chart). We attribute that to lack of liquidity, but now that the Nov 3rd falls within the 1Y tenor, we expect the gold pricing of the event to correct.

The earlier analysis identified XAU, JPY and CHF as the majors most reactive to political risk. Exposed to 0.8 vol rolldown to spot vols on mids, 1M in 11M XAUUSD FVA @12/13.5indic could be considered for a catch-up 2vol upside with respect to the FX vols pricing of the US election risk. Courtesy: JPM

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch