The NZD primarily nudged higher only to subsequently drift lower, again discovering itself halting near strong support zone, although like yesterday it is not certain to have adequate momentum to break through ahead of tomorrow’s RBNZ decision.

Ahead of Kiwis monetary policy, the RBNZ inflation expectations survey slipped from 2.1% to 2.0% in Q1, but risks a rebound in Q2 amid wider signs of gradual inflation pressures.

The short Antipodean view has been motivated by multiple factors, all of which remain intact:

a) The structural bearish standpoint on both currencies on the expectation that unlike a lot of G10 central banks, the two RBA and RBNZ will remain on hold throughout 2018 and most noticeably, the RBNZ inflation expectations survey dropped from 2.1% to 2.0% in Q1, but risks a rebound in Q2 amid wider signs of gradual inflation pressures.

b) The duos (AUD & NZD) would be the most vulnerable in G10 given the recent escalation in trade conflict.

Over 2018, we foresee scope for some further under- performance from NZD, as we expect ongoing confirmation that the RBNZ can credibly lag policy normalization in the G3.

A key development for these currencies in the past week has been China’s announcement of making its fiscal policy more active in 2H’18 which could improve the tone around commodity FX in general (via its implication for commodities and infrastructure spending), but our expectation is for such optimism to be limited given the downside tail risks to growth from a further escalation in trade conflict.

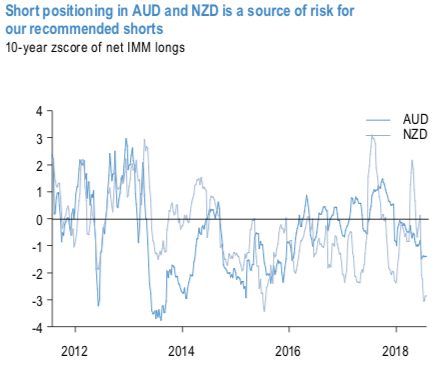

Nonetheless, that shorts in both AUD and NZD are outsized (refer 1stchart) are a cause for concern and thus continue to warrant monitoring of the mix in China's policy response in the coming weeks, making us tactical on these trades (a preference for fiscal/infrastructure over monetary would be more supportive for Antipodean FX).

Near term seasonals are on the margin are also supportive of our bearish view on high beta FX, as USD typically tends to strengthen in August vs. high beta FX (AUDUSD and NZDUSD on average have weakened by 1.4% and 2.3% in August over the past 5- years, respectively; refer 2ndchart).

Long a 3m AUDJPY put, strike 77.50, short a 3m AUDJPY 81.25-83.50 call spread. Received 0.5bp on June 20th.

Short NZDUSD through a covered put. Book profits on short cash from 0.6893 for +0.88%. Stay short a 2m 0.6677 NZDUSD put for 39.6bp. Marked at 9bp. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 58 levels (which is bullish), hourly AUD is flashing at 93 (which is bullish), JPY is at 66 (bullish), while USD spot index was at 51 (bullish) while articulating (at 11:49 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios