RBNZ’s monetary policy that is scheduled for Wednesday. The kiwis central bank cut 50 bps in its August meeting and had said that there was room to cut further "if required." We interpret this as an easing bias rather than a signal. In other words, the RBNZ views a cut as more likely than a hike, but is not committing to either at this point. We reckon that the prevailing rallies of NZDJPY are momentary, NZD is expected to depreciate towards 67 levels by year-end.

Although NZDJPY shows interim rallies upon hammer and dragonfly doji patterns 70.229 and 70.157 levels respectively, these upswings seem momentary as the overbought pressures The decline in January could extend below 70.00 if the coronavirus epidemic persists.

Event risk during this week comes from wage data and a leading index. Although we have a positive outlook for the NZ economy in 2020, the global risks are expected to persist.

Hence, it is wise to capitalize on interim rallies and optimize ‘debit put spreads’ ahead of the central bank’s policy event. Before we deep dive into the hedging framework, better to be aware of bearish driving forces of NZDJPY.

Bearish NZDJPY scenarios:

1) Tightening by banks forces a deeper slowdown in credit growth, and weakens the agricultural sector;

2) The immigration rolls over more quickly.

3) The global investors’ risk aversion heightens significantly;

4) Global economy enters serious recession; and middle-east tensions escalate sharply.

OTC Updates, Trade and Hedging Recommendations:

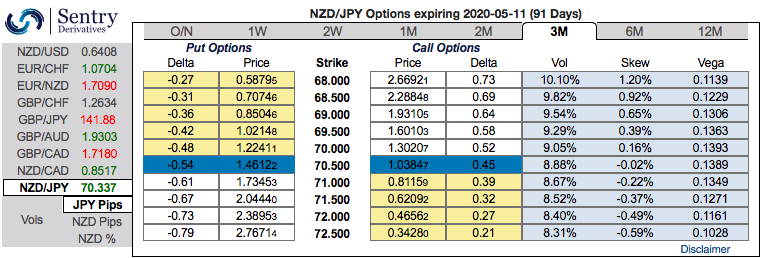

The positively skewed NZDJPY IVs of 3m tenors signify the downside risks, the bids for OTM put strikes up to 68 levels clearly indicates hedgers are inclined for further downside risks (refer above nutshells evidencing IV skews). The major downtrend continuation shouldn’t be panicked the broad-based bearish outlook amid minor rallies.

Hence, it is conducive for OTM put writers capitalizing on short-term rallies so as to reduce long-leg meant for downside hedging.

The execution of strategy goes this way: Initiate longs in at the money -0.49 delta put options of 3m tenors, simultaneously, short (1%) out of the money put options of the narrowed expiry (preferably 2w tenors), the strategy is executed at net debit (activated when spot reference: 70.957 levels).

Well, a higher (absolute) Delta value is desirable on long leg in the above stated strategy. Whereas, the Theta is positive on short leg; as the time decay is good for an option writer (that’s why we’ve chosen narrowed expiry). The short side likely to reduce cost of hedging with time decay advantage on short leg, while delta longs likely to arrest potential bearish risks.

Alternatively, shorts in the mid-month futures have been advocated with a view of arresting further downside risks. Courtesy: Sentry

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility