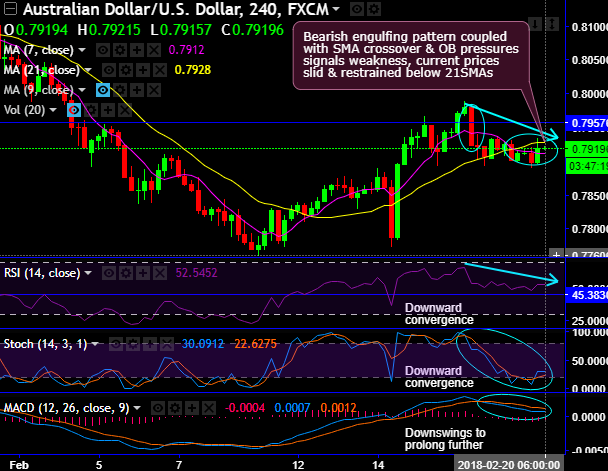

Chart and candlestick pattern formed: Bearish engulfing & long-legged doji candlesticks on the intraday chart (refer 4H chart) and the potential double top pattern has occurred on weekly plotting.

Bearish engulfing and long-legged doji patterns have occurred at 0.7923 and 0.7921 levels respectively that have currently evidenced considerable price slumps below SMAs.

These bearish patterns are coupled with bearish SMA crossover & overbought pressures signals continued weakness. For now, the current prices slid & restrained below 21SMAs.

Although mild rallies are observed today soon after RBA’s monetary policy minutes, the stiff resistance is seen at 21SMAs, 0.7957 and 0.7980 levels. In the recent past, previous rallies have been little edgy at this juncture.

On a broader perspective, the pair has been going through consolidation phase after a massive downtrend, where a potential double top formation seems to be most likely with top 1 at 0.8125 and top 2 at 0.8135 levels. Although this pattern is bearish in nature, still the major trend goes non-directional (refer weekly plotting).

Both leading oscillators (RSI & Stochastic) have been showing downward convergence, momentum seems to be little edgy for now on daily terms, hence, ongoing rallies are quite dubious.

While both lagging indicators (7 & 21 DMAs, EMAs & MACD) signal extension of bearish swings.

Trade tips: Well, on trading perspective, at spot reference: 0.7920, it is advisable to buy tunnel spreads using upper strikes at 0.7945 and lower strikes at 0.7880 levels, the strategy is likely to fetch leveraged yields as long as underlying spot FX keeps dipping but remain within these strikes on or before the binary expiry duration.

Alternatively, on hedging grounds, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards 0.75 levels in the medium run.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 48 levels (which is bullish), while hourly USD spot index was at 94 (bullish) while articulating (at 06:32 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty