The FX markets for sterling were taken by surprise in mid-April when Theresa May called a snap general election, but aside from an initial flurry of excitement, FX investors had shown little interest in what the opinion polls indicated was a one-horse race.

In our judgement the election will not affect the modal outcome for Brexit or GBP assuming that the Conservatives win – Brexit is still likely to feel rather hard insofar as it is liable to circumscribe the UK’s single market access, even if the change in the electoral timetable should temper the tail risk of an outright disorderly Brexit in 2019.

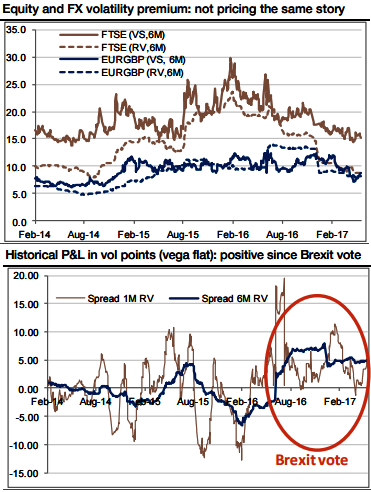

We expect Brexit to lift EURGBP vol more than FTSE vol. Accordingly, we advocate variance swaps in our recent write-up. The rationale is that EURGBP volatility should be more impacted than FTSE100 Brexit asymmetry. After almost a year of debate and strong talks, the UK and EU are going to enter into the phase of exit negotiations.

On the one hand, we believe that the pound will stay under strong pressure, as the UK economy should eventually suffer from the inflationary effect of a depreciated currency.

On the other hand, the FTSE100 should show some resilience, as corporate activity generally benefits from a weaker currency.

As such, we expect EURGBP implied and realized vols to rise steadily, while volatility on the FTSE100 (comprised mainly of largely international groups with only limited local exposure) should remain relatively less impacted. Options markets are pricing a totally different story.

The FTSE 6m implied vol is trading at a substantial 6.6 vols premium above the realized vol (15.4 vs 8.8, respectively), while EURGBP 6m implied vol is consistent with realized vol. The EURGBP skew flipped towards GBP puts, suggesting upside potential for sterling vol as the GBP depreciates.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data