In conjunction with the Fed’s unchanged policy decision, more dovish signals have been received from the FOMC members on the US policy outlook.

While the US industrial production MoM has disappointed the streets by missing the forecasts, actual -0.4% versus forecasts at -0.2% and previous flash at 0.6%.

On the flipside, in last week, the UK produced upbeat manufacturing production despite unfavourable hot news to their business, prints actual numbers at 2.3% versus forecasts at 0.0% and previous flashes at 0.1%.

While industrial output in the United Kingdom grew 2% in April from March of 2016, following a 0.3% gain in the previous period and beating market expectations of a flat reading.

Despite these industrial numbers that could act as a positive driver to prop up British pounds’ strength against the dollar, has completely shrugged off the above mentioned supportive numbers for GBP, this would divulge the intensity of potential Brexit event. The pair continued its bearish streaks to trade at 1.4155 (-0.34% loss from previous close).

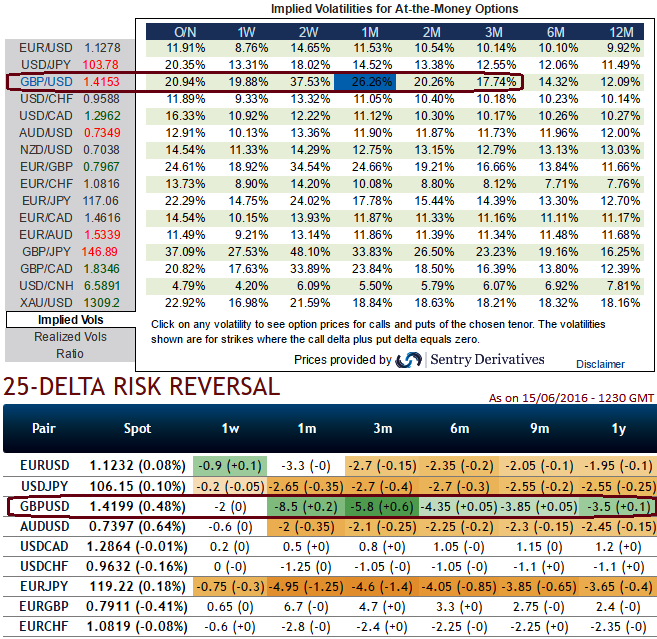

Elsewhere, no need to specify GBP vols have been flying with sky rocketed pace no matter what both prior and post-Brexit event.

ATM IVs of GBPUSD for 1w expiries are flashing at 19.88%, spiking crazily at 37.53% for 2w tenors and more than 26.26% in 1m tenors, while puts seem more expensive than calls (downside protection is relatively more expensive) as you can see the highest negative risk reversal adjustments.

These computations indicate the difference in volatilities, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market.

Moving on, the big tail risk of this potential event is evidencing its effects on sterling. We estimate the risk of Brexit at 45% and the accumulated negative shock to the economy at 4-8% over five years.

We remain, bears of GBP/USD, as the BoE MPC is scheduled for today which is likely to defer the decision and keep bank rates at 0.50% due to the ’Sword of Brexit’ is hanging over confidence.

Stay short in GBP/USD through diagonal put spread, hold 2m GBP/USD (1% ITM strikes & -1.5% OTM strikes with shorter expiry) debit put spread.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?