G10 trades have done well over the past six months. We took profit on NZD/CAD shorts in February and like to reopen it following large NZD gains recently.

A preference for oil and US-sensitive CAD to China-sensitive NZD remains a core long-term theme.

The CAD will benefit from residual USD strength (North American bloc) and further oil price gains in the long run.

These trades reflect the Antipodean exposure to China, likely rate cuts, and preference for oil over base metals. In both cases, valuation remains appealing. The AUD and NZD are our least-preferred G10 currencies for H2. We also like to cheapen AUD/USD puts with a low knock-out.

As NZD is exposed to RBNZ cuts and a Chinese slowdown, maintain shorts in NZD and also in AUD/NOK (cost 0.45% per quarter).

On the flip side, there are several fundamental cross-currents affecting the NZ dollar. The housing market continues to be buoyant and interest rates are relatively high among G10 currencies. On the other hand, milk prices have been weak, inflation has surprised to the downside and the currency remains overvalued.

New Zealand's exports of primarily soft commodities are less tied to the global industrial cycle, nonetheless, low milk auction prices are causing a cash crunch in the important and highly leveraged dairy sector. As a result, we’ve GDT index falling massively, -0.4% versus previous 0.0%. We call for RBNZ’s scope for cuts in OCR.

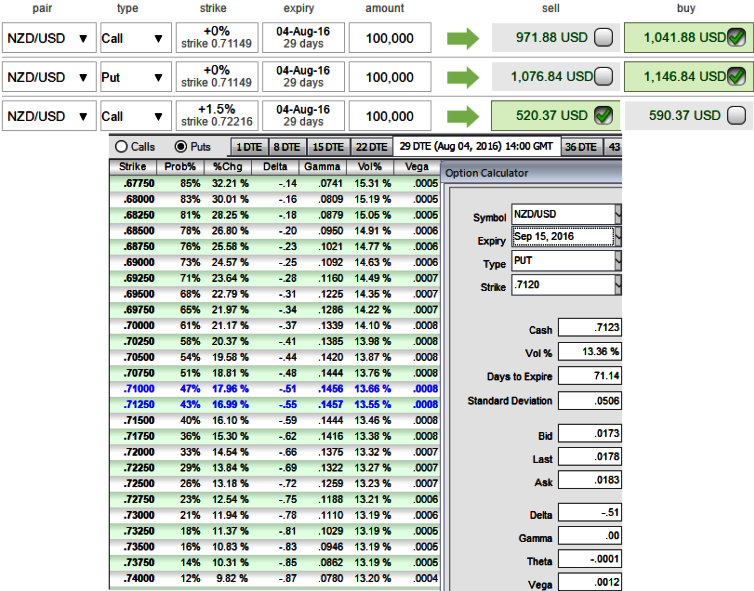

On hedging grounds, since 2m ATM IVs of NZDUSD are trading more than 13.25%, it is advisable to initiate longs in NZD/USD 3M At the money delta put, while going long in 3M at the money delta call and simultaneously, Short 1M (1.5%) out of the money call with positive theta.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?