The bearish CADJPY scenario below 79 driven by:

1) The US moves ahead on border adjustments or NAFTA negotiations turn sour;

2) US-Canada trade negotiations turn acute and negative with a proliferation of high-profile trade enforcement actions by the US;

3) Commodity prices fall much further on China/global growth concerns;

4) Wobbles in the housing market cause a broader instability in the financial system.

The bullish CADJPY scenario above 87.092 driven by:

1) BoC indicates the intention to normalize rates earlier due to an improved global outlook.

2) Global demand pushes oil prices well above $60.

CADJPY is one of the better candidates since recent CAD weakness has undershot recent moves in oil and rate spreads

Hedging Strategy: Option strips (CADJPY)

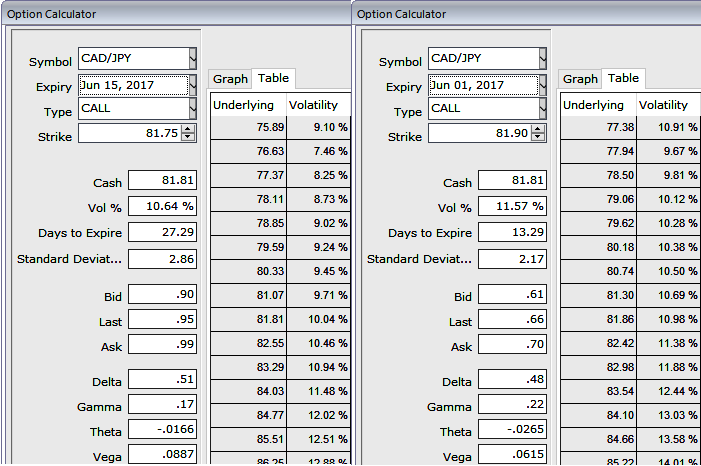

Please be noted that the ATM IVs of this pair has been inching higher at 11.57% and 10.64% for 2w and 1m tenors respectively. The higher IVs have been the good news for option holders.

Go long in 2 lots of 2w ATM -0.49 delta puts, while long in 1 lot of +0.51 delta call of the same expiry, See that payoff function the strategy likely to derive positive cash flows regardless of swings but more potential from 2 puts are more than 1 call.

The risk is Limited to the price paid to buy the options.

The reward is Unlimited till the expiry of the option.

Please note that the trader can still make money even if he was wrong, that means the strategy likely to derive handsome yields in premiums regardless of swings. But the spot FX has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?