Bearish GBP scenarios:

1) Sub-1% growth as the consumer squeeze is aggravated by falling house prices.

2) Insufficient progress on the Brexit divorce delays the start of talks on a new trade deal beyond October.

3) Capital repatriation from long-term investors including central banks.

Bullish GBP scenarios:

1) The govt. formalises a lengthy transitional deal with the EU which maintains the status quo for 2-3 years.

2) The economy rebounds to 2%.

3) MPC commentary seeks to steepen the yield curve.

4) Current a/c deficit shrinks below 2%.

Bearish JPY scenarios:

1) Hawkish shifts by other G10 central banks accelerates to lead wider rate spreads with Japan and

2) Japanese government’s fiscal policy becomes more expansionary and the BoJ finances it, resulting in higher Japan’s inflation expectations

Bullish JPY scenario:

The global investors’ risk aversion heightens significantly, possibly due to deterioration in North Korea situation and/or US-Japan trade frictions.

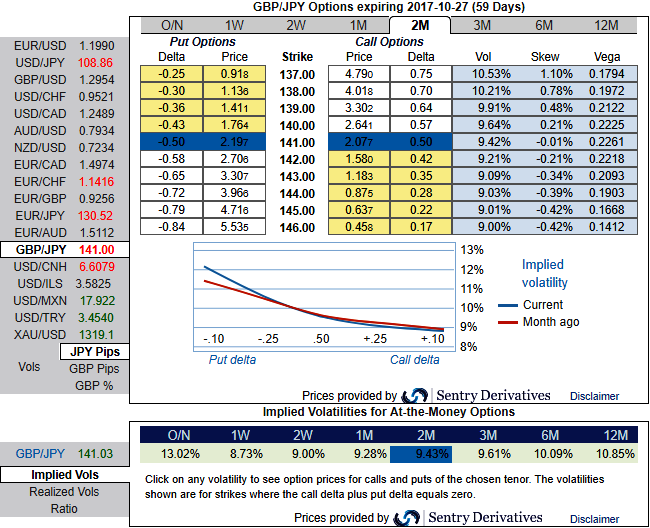

OTC outlook and hedging framework:

Please be noted that the positively skewed IVs of GBPJPY of 2m tenors signify the hedgers’ interests in OTM put strikes. Whereas IVs of these tenors are just shy above 9.43% which is highest among G7 currency space, while higher IVs with positively skewed IVs signify the hedgers’ interest for both OTM call/put strikes. In usual circumstances, long option position needs higher IVs for significant change in vega. Hence, we capitalize on buzzing IVs and improve odds on options below strategy.

With this interpretation, one can judge whether the options with a higher IV cost more. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good.

Thus, we advocate weighing up above aspects as we eye on loading up with fresh vega longs for long term hedging, more number of longs comprising of ATM instruments and OTM call shorts in short term would optimize the strategy.

The aggressive volatility investors want to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility.

Further GBPJPY upswings and/or abrupt weakness suggest building a directional strategies and volatility patterns at the same time.

Contemplating IV skewness and ongoing technical trend in the consolidation phase, we foresee the value of OTM options would likely rise significantly as the IVs seem to be favoring long legs of ATM strikes.

Courtesy: JP Morgan

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts