Last Friday's, the rate charge by BoJ makes commercial banks that park surplus reserves at the central bank to negative 0.1% in a slightly awful stimulated pointing at serving its economy to cushion the potential threats of deflation.

By pushing rates into negative territory, the BOJ is in effect penalizing commercial banks for not lending aggressively by charging the institutions for holding excessive reserves at the central bank.

Soon after the unanticipated monetary policy decision, major central banks in the world have now begun offering rates in negative territory for the first time ever. The BOJ's unprecedented move follows a similar policy implemented by the European Central Bank in 2014.

The dovish position from the BoJ could influence the Fed to bring in deferral for further tightening measures, as other top global economies continue to show signs of weakness. On Wednesday, the Federal Open Market Committee (FOMC) left its benchmark Fed's funds rate unchanged between 0.25 and 0.50%.

This dovish measure by BoJ has been perceived as fraught effort to boost insistently tepid inflation. While Japan's annual core CPI increased subtly by 0.1% in November, which was the 1st increase in last 5 months. Japanese Core CPI, which strips out fresh food prices, remains significantly below the BOJ's price target.

The BOJ is currently pumping ¥80 trillion into the Japanese economy ($674 million) through a large-scale quantitative easing program that has achieved varying amounts of success over the last three years.

Kuroda cited increased risks pertained to the Chinese economy struggling and EM's slowdown, as well as extensive volatility in global financial markets at the beginning of the year. Kuroda indicated that the BOJ will extend the negative rate policy "as long as necessary."

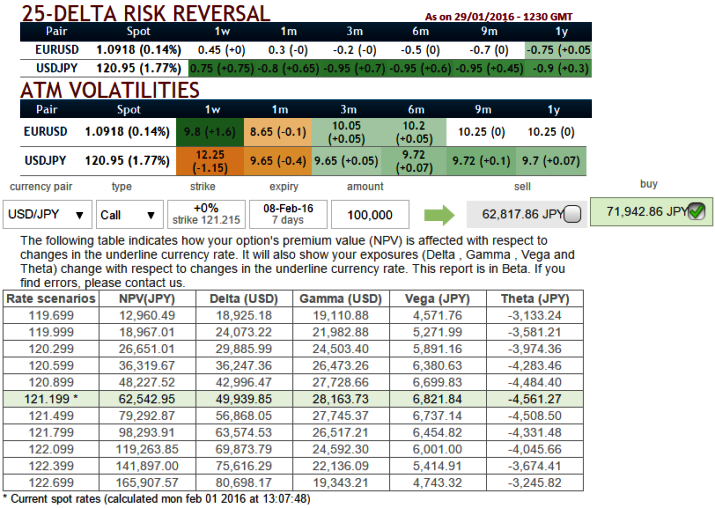

As such, we discuss some key considerations that relate to economic developments herein, assessing risks ahead of the central bank's policy stance in the months to come and yen's gains against dollar. Please be ntoed that the ATM calls are trading 15% more than NPV which is in line with the OTC market sentiments (no deviation from the delta risk reversals commpuutaion). So shorting such calls using narrrow expiries in the diagonal spreads would likley to derive certain yields.

Keeping all these factors in mind, it is advisable to go long in 1M (1%) OTM 0.16 delta call while writing 2W (1%) ATM call with positive theta and delta closer to zero (both sides use European style options), this bear call spread option trading strategy is recommended when the USDJPY spot FX is anticipated to slump moderately in the near term.

As we can see from the risk reversal table, the OTC market is hinting a slight recovery but long term bear trend may resume sooner, the bear call spread option strategy is also known as the bear call credit spread as a credit is received upon entering the trade.

FxWirePro: BoJ dovish tone likely to defer FOMC’s tightening - USD/JPY’s spike is momentary, speculate with credit call spreads

Monday, February 1, 2016 8:45 AM UTC

Editor's Picks

- Market Data

Most Popular