So what is happening with the euro? There has been relatively little news on the European currency over the past weeks. This is partially due to the fact that the FX market is currently focussing on the protectionist measures threatened by the US and thus on the US dollar. Secondly, the euro hardly moved recently, as our currency indices illustrate. This may change briefly today as a result of the ECB meeting, as the ECB council is likely to discuss today when it is going to change its official communication and further pave the way towards an end of the expansionary monetary policy. The market will pay particular attention to references as to when the ECB will end the asset purchasing programme.

While SNB is also scheduled for libor rate announcement next week, we have been short EURCHF for nearly a month now as we believe the cross is in a shallow downtrend reflecting the earlier cessation by the SNB of its balance sheet expansion by comparison to the ECB.

We also believe that the SNB will not be far behind the ECB in starting to normalize interest rate policy next year as the franc is close to its long-term average level, inflation is above its average, and the economy continues to accelerate.

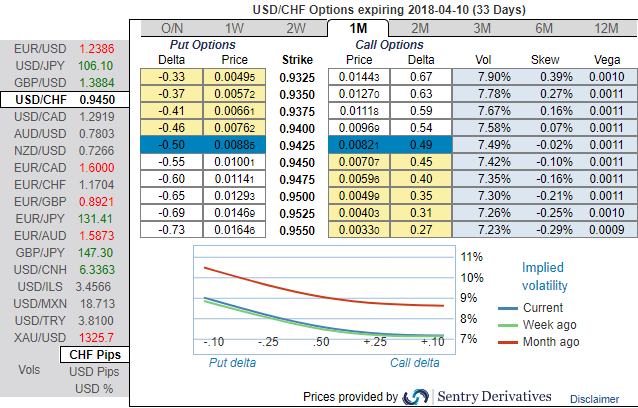

However, we don’t believe that the SNB will sanction a material rise in the franc in the event of a disruptive outcome to the ECB monetary policy, Libor rate from SNB, Eurozone service and manufacturing PMI, and so we sell USDCHF via 1m put against the cash position in order to monetize the modest risk premium priced in CHF vols.

A few people may have also been unsuccessfully short USDCHF over the past month through a cheap RKO put. We are comfortable rolling the option position into an outright cash trade in view of Trump’s trade actions this week.

The OTC indications are conducive to these options positions. Please be noted that positively skewed IVs of USDCHF and EURCHF of 1m tenor are signifying hedgers’ sentiments for the bearish risks. This indication is coupled with 1m RRs of USDCHF show bearish neutral risk reversals. Hence, we advocate to hold -0.49 delta ATM put of 1m tenor.

Currency Strength Index: FxWirePro's hourly USD spot index has shown -35 (which is bearish), while hourly CHF spot index was at -149 (highly bearish) while articulating at 11:50 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/fxwire/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist