The meetings of the major central banks should dominate this week, namely the Fed, the ECB and the BoJ. The ECB meeting, in particular, should be interesting, as the QE exit will be on the agenda. We expect dovish accompanying signals and do not share the general market euphoria about the alleged beginning of the end of the unconventional ECB policies.

There are positive signs from Italy, where the new government seems to be more interested in a sound fiscal policy than initially feared. Finance minister Giovanni Tria, in particular, sounded quite cautious over the weekend. “More generally, we will not accept measures which, even unintentionally, could cause financial instability.” This might be a quote by Wolfgang Schäuble. This is sufficient for the FX markets to trade the euro stronger. The Italy induced mini-crisis is over and already forgotten.

But our bullish stances on precious yellow metal is essentially a leveraged bet on the weakening dollar despite FOMC season. An upside option with the limited downside that we believe is highly likely to move into the money. Based on our historical analysis, in the unlikely event the dollar rallies through the late cycle (only 1 out of the last 6 cycles), the resulting gold losses were relatively tame (8%).

However, on the flip side, over the 5 cycles when the dollar weakened over the last quartile of expansion, gold prices increased over 40% on average even before the subsequent recession dynamics pushed prices even higher. To us, this looks like a relatively cheap upside option.

Even following the recent bounce the back end XAU/EUR vols are only 1vol from the multi-decade low.

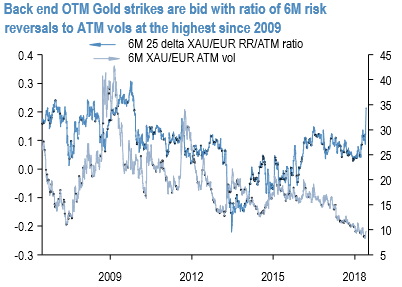

Reminiscent of poor EUR sentiment topside OTM Gold strikes got bid to the highest level since 2009 (in terms of the ratio of 6M risk reversals to ATM vols) – (refer 1st chart).

This setup helps economize bullish Gold play while hedging EUR risk and is supportive of call spreads that sell overpriced OTM strikes to cheapen already cheap ATM strikes.

At 220bp XAU, 6M ATM/25D XAU/EUR call spreads are the cheapest in more than a decade (refer 2nd chart).

We recommend6M XAU/EUR call spread (strikes 1115/1165) that costs 135bp XAU (ref spot $1302.86), at 3 times leverage and 49% discount to outright vanilla.

Alternatively, the more likely upside scenario for gold has returned multiples of this potential loss. With our forecasts still calling for a resumption of a synchronized global growth and hence a resumption of the medium-term trend lower in the dollar, we consequently maintain our bullish view on bullion.

Initiated longs in CME gold for Dec’18 delivery at $1,352.80/oz. Added an equivalent unit at $1,327/oz in May 2018 for a new entry level of $1,339.90/oz. Trade target is $1,540/oz with a stop at $1,273/oz. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic