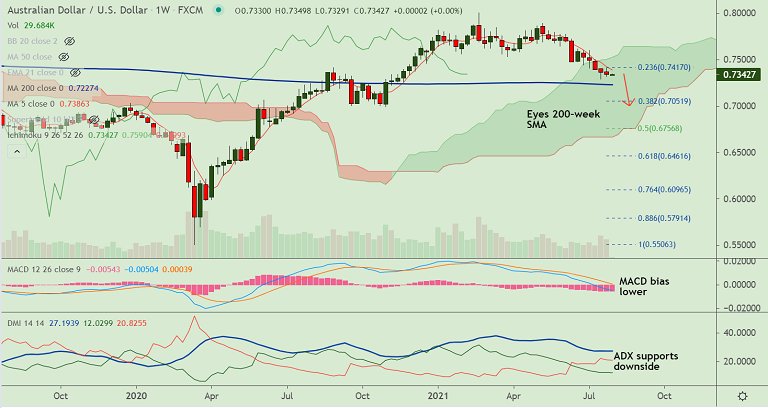

AUD/USD chart - Trading View

AUD/USD was trading largely muted on the day at 0.7343 at around 04:30 GMT, outlook remains bearish.

Dismal Chinese Caixin Manufacturing PMI and escalating covid concerns in Australia are likely to keep the pair on the back foot.

A survey by Markit Economics showed on Monday that China's factory activity growth slipped sharply in July as demand contracted for the first time in over a year.

Caixin China Manufacturing PMI for July printed at 50.3, missing expectations at 51.1 and compared to 51.3 in June.

The US dollar's strength adds to the downside bias. Focus now shifts to the Reserve Bank of Australia’s (RBA) monetary policy meeting due this Tuesday at 0430 GMT.

Analysts expect the RBA to stand pat amid resurging Delta covid strain woes, which suggests no relief for the AUD.

The Australian dollar is likely to face further downside risks if iron ore prices continue to keep falling.

Technical analysis also supports weakness. 'Death Cross' on the daily charts keeps any upside limited.

110-week EMA is immediate support at 0.7307. Break below will drag the pair lower. 5-DMA is immediaate resistance at 0.7362. Upside continuation only above 21-EMA.

200-week MA is major support for the pair at 0.7227. Break below will open downside.