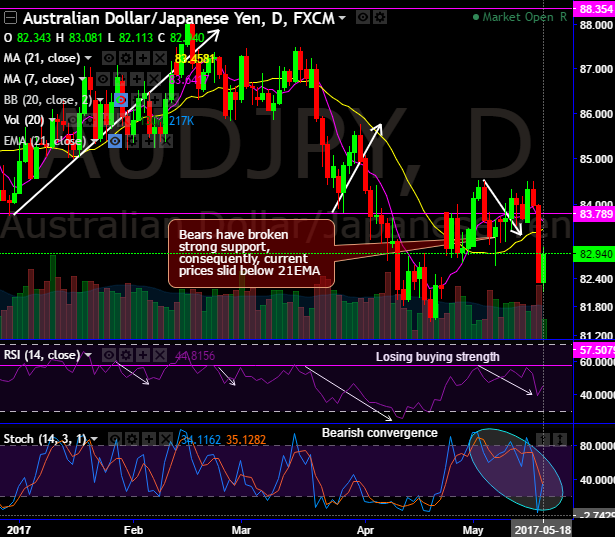

Bears have managed to break below strong support at 83.789 levels. That is where a mighty bearish engulfing candle has occurred with huge volumes.

As a result, current prices slid below 21DMA despite today’s upswings.

On a broader perspective, after 7-8 months of consolidation phase now seems to be totally exhausted at 50% of Fibonacci retracements from the lows of 72.437 levels (Jun’16 lows). Shooting star pattern candle has occurred at 86.327 levels (i.e. near 50% Fibos) to indicate weakness in this pair.

Ongoing rallies are struggling to break out above 21DMA and 21EMAs; consequently, current prices are hovering at 38.2% Fibonacci retracement levels.

For now, more slumps seem on cards as the breach below 38.2% Fibos has been a better bearish clarity, current prices dropped below 7EMA.

The leading oscillators (RSI & stochastic curves) are also sensing overbought pressures, you observe the leading indicators are totally exhausted to signal strength in the previous uptrend at this juncture (refer monthly plotting).

To substantiate this weakness, stochastic evidences %d crossover right from the overbought zone (i.e. 80 levels) to signal the intensified selling sentiments. MACD has remained below zero level which is bearish trajectory.

Trade Tips:

Well, as a result of above technical reasoning, on speculative grounds we advise tunnel spreads which are binary versions of the debit put spreads.

This strategy is likely to fetch leveraged yields than spot FX and certain yields keeping upper strikes at 83.125 and lower strikes at 82.248 levels.

While we advise using short positions in futures contracts of mid-month tenors for hedging downside risks upto 81.335 levels.