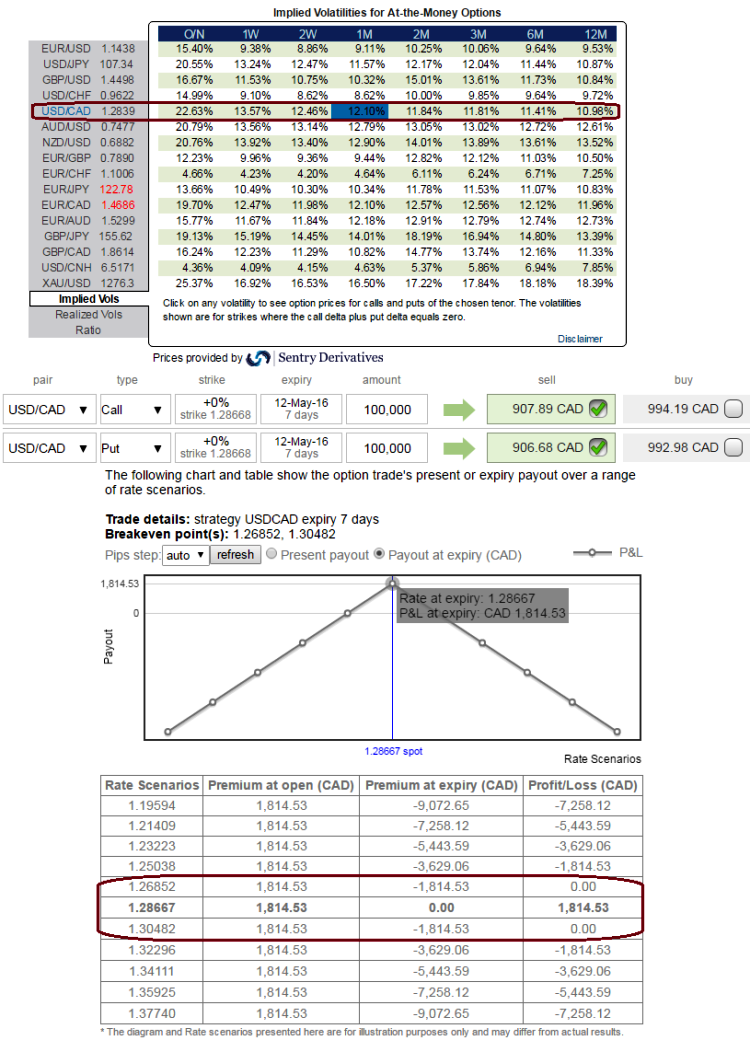

USDCAD spot FX is trading at 1.2838. IVs of 1W ATM contracts are at 13.57% and 12.10% for 1M tenors.

As the IV is likely to reduce in near future, let's suppose that we execute an option trading positions by shorting 1W at the money put for CAD 906.68 and short an at the money call of same expiry for CAD 907.89.

Thereby, the total premiums received for selling the options is CAD 1814.57.

While going long in 1000 units of spot FX of USDCAD, the cost of going long in spot would be CAD 1123.80.

On expiration, even if USDCAD rallies upto 1.3048, then you would be at break even as shorts on puts would be certain yield you may have to cover short calls with difference.

On contrary, if it dips upto 1.2685, even then you would be at break even as calls would be certain yields, short puts need to be settled and needs to be bought back while the long spot position has lost a bit, the gains on short calls could be utilized for offset the loss incurred.

In case of exercising obligation on puts, that would be taken care by these spot outrights.

Covered straddles are limited returns, unlimited risk options strategies similar to the writing of covered call. But considering the reducing volatility factors, using narrowed strikes would help in this strategy. A seller wants IV to fall so the premium falls. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

Another way to describe a covered straddle is that it is simply a combination of a covered call write and a naked put write.

Since the naked put write has a risk/reward profile of a covered call, a covered straddle can also be thought of as the equivalent of two covered calls.

Maximum gain for the covered straddle is reached when the underlying spot FX on expiration date is trading at or above the strike price of the options sold.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022