Four years ago, following the election victory of Donald Trump the dollar achieved a remarkable rally. While the risk sentiment has been optimistic with the US equities extending their recovery, now up 10% from their lows just over two weeks ago, the move remains fragile and built on the hopes that a stimulus package in the US will eventually be seen. Some support perhaps coming from the latest polls that continue to show Biden as frontrunner in the run-up to the Presidential elections. The US dollar has followed this theme, with the Bloomberg USD Index sliding back to the lows from the beginning of September. A slight wobble in this USD decline overnight with the news that the PBOC lowered the risk reserve ratio to zero from 20%, making it less expensive to bet against the CNH.

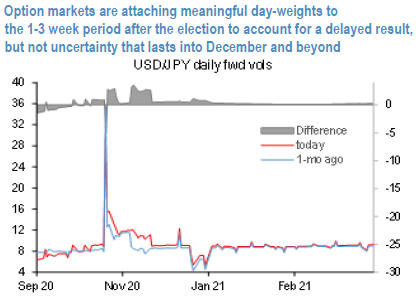

How much of a delay in election results are option markets pricing in? We reckon that the risk of an extended period of ballot counting has been priced into the 1-3 weeks period after the election, but a more material delay – say on account of a legal challenge to the vote count – that stretches into mid-December or even January is deemed unlikely by the option markets at this stage. A snapshot of daily forward vols for USDJPY illustrates the pricing of the delay tail more granularly: overnight vols are not anticipated to unwind their election-related jump till well into November, which was not the case till a month ago (refer 1st chart). Based on the daily vol time series, we estimate the delay premium to shrink to 0.3-0.5 vol pts for the first half of December.

Are there cheap post-election delay hedges still left in FX vol? The short answer is yes, in the Yen / cross-Yen complex. 2nd chart maps the universe of 2M2M forward vols on two standard measures of value related to historical rich/cheap and the magnitude of premium/discount relative to immediate post-election vol (November 3-10 forward vol). “Cheap” risk premium is concentrated in the Yen-bloc: USDJPY FVAs are the most lightly priced, but traditional higher beta crosses such as JPYKRW and AUDJPY are not materially worse.

For hedgers, USDJPY offers the key advantage of liquidity, but we are not overly enthused by its ability to deliver even in moderate to severe risk-off market conditions, judging by their disappointing showing in market downturns of recent years. So long as the macro narrative for USDJPY remains one of a gradual shift in the balance of influence away from the heavy institutional Japanese outflows of the Fed hiking years towards Japan’s rising real yield advantage over the US, Yen appreciation is likely to remain an orderly process and unlike to reward vol owners today with the fearsome carry trade deleveraging of the GFC era. Liquidity permitting, our preference would be for higher beta Yen-crosses like AUDJPY that have a well-established track record of outperforming USDJPY during vol spikes.

Our short 4wk vs buy 8wk 104.2 strike USDJPY put one-touch calendar spread was knocked-out on September 21st at a PNL of -16.5%. Courtesy: JPM

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand