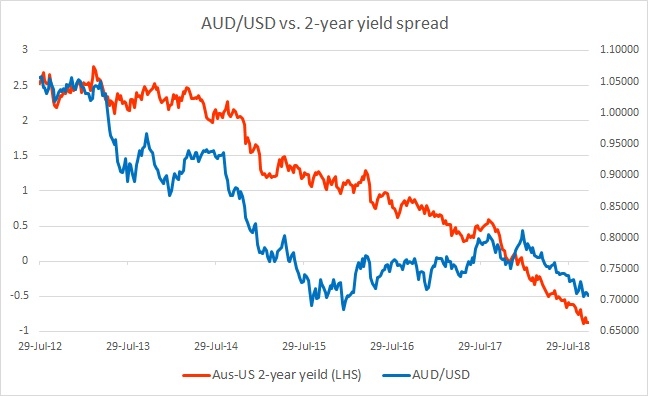

The chart above shows, how the relationship between AUD/USD and 2-year yield divergence has unfolded since 2012.

The chart above makes a clear case of closeness between the rate spread and the exchange rate. The spread between the 2-year U.S. Treasuries and the 2-year Australian government bond declined from +253 bps to -72 bps. AUD/USD responded by declining from 1.056 area to 0.729 area.

We expect the trend to continue as the spread is showing no signs of a rebound and the Reserve Bank of Australia (RBA) continues to maintain its semi-dovish commentary amid a hawkish Federal Reserve in the United States.

In the month of October, the spread has further declined to -88 bps and the Australian dollar responded by declining from 0.729 area to 0.707 area.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022