The FOMC is largely expected to remain patient in the current environment at its 26-27 January 2016 meeting and its outlook for the labor market and inflation is unlikely to change materially. Focus will remain on the following statement and market participants will be looking closely for clues regarding a possible March rate hike. Data since the December Fed meeting has definitely not been supportive of further tightening any time soon. The FOMC has emphasized the importance of incoming data to their decisions going forward. And in the current scenario a March increase also looks like a close call.

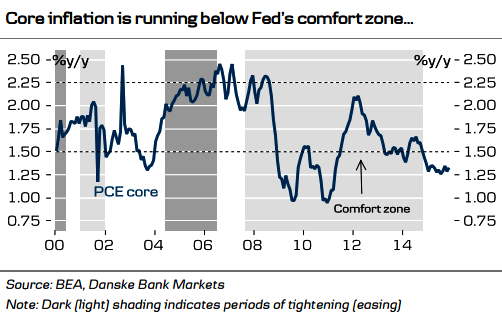

The Fed is expected to keep the Fed funds rate target unchanged at 0.25-0.50%, and may sound dovish in the accompanying statement. Much has happened since December 2015 meeting, following the initial lift-off. The oil price has slumped further, owing to the renewed concerns about the slowdown in the Chinese economy and Middle-East tensions. The US equity markets have had the worst start to the year, long-term market inflation expectations have declined and data have been weak. The statement is likely to acknowledge these developments. The subdued core inflation will probably give the Fed time to stay patient before moving on with the next hike.

The Fed has on several occasions communicated that it will monitor incoming data and the financial conditions before moving on with the next hikes. It is definitely going to be a tough task for the FOMC to acknowledge the recent deterioration in economic and financial conditions while at the same time keep the door open for a possible interest rate move in March should the recent deterioration proves temporary.

"We expect the Fed to recognize that two months are not enough to ensure that the upturn remains on track. We think the FOMC will reinstate phrases that it 'is monitoring global economic and financial developments' (or something similar), which were removed in the December statement", says Danske Bank in a research note.

Markets also worry that the Fed might tighten too much too quickly, especially since US data has disappointed recently. This was evidenced in a relief rally post Bullard's comments in which he expressed his concerns about the falling inflation expectations. Markets have priced in one full hike this year and one hike next year. They have assigned a 25% probability of the second hike in March, 36% in April and 56% in June.

"Our central scenario assumes a March increase and a total of three hikes this year. Admittedly, March looks like a close call at the moment given the recent slowdown in activity and tighter financial conditions." says Societe Generale in a report.

The dollar remained subdued, struggled to hold ground on Wednesday as the market await for clues on interest rate policy from the Federal Reserve. The dollar index was barely changed, 0.01 percent down at 99.026 at 0940 GMT. At the time of writing, EUR/USD was trading at 1.0867, while USD/JPY was at 118.24.

Expect no policy action at FOMC meet, March also likely to be a close call

Wednesday, January 27, 2016 10:26 AM UTC

Editor's Picks

- Market Data

Most Popular

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist