The IHS Markit Eurozone Manufacturing PMI fell to 33.6 in April of 2020 from 44.5 in March and below market expectations of 39.2, preliminary estimates showed. Figures pointed to the biggest drop in factory activity since February of 2009 as measures taken to contain the coronavirus outbreak led to temporary business closures and draconian restrictions on citizens’ movement. Manufacturing output and new orders fell to record low levels; employment went down at the fastest pace since April of 2009; and supply chain delays hit the highest ever reported. Also, expectations of output in the coming 12 months dropped to a new record degree of pessimism.

Contemplating all these factors, it appears that the EU staged for this year towards a 5-10% economic contraction owing to the pandemic coronavirus crisis. From the onset of the COVID-19 crisis, we have rejected the notion that EUR could function as an effective safe- haven for any extended period of time. We’ve explicitly emphasized EURJPY’s minor downtrend that has been constant ever since the failure swings at the peaks of 121.144 levels and accordingly, advocated hedging strategies to arrest the bearish risks. These strategies are efficiently functioning as per our expectations. Please refer the below weblink for more reading:

Those who have referred this write-up and initiated the above strategies, would have undoubtedly safeguarded their euro exposures against JPY, and the rest is history by now.

The initial surge in euro crosses when equities first cracked may have been impressive – the negative co-movement between EUR and equities was the most extreme on record – but in our view this was caused by inherently temporary, one-time unwinding of a certain class of EUR-funded financial market carry trades.

BoJ is scheduled for their monetary policy on 24th of this month and ECB is also lined-up for their MPS by the end of April.

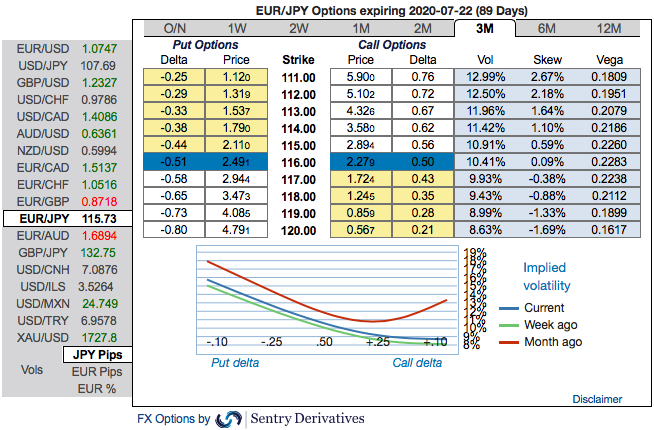

Hence, ahead of these monetary policy events, at spot reference: 116.027 levels, we uphold 3m EURJPY (1%) ITM -0.79 delta puts for aggressive bears on hedging as well as trading grounds as the mild abrupt upswings were contemplated earlier.

Rationale: The positively skewed EURJPY IVs of 3m tenors are signifying the bearish risks in the underlying spot (refer 1st exhibit). The bids for OTM puts indicates that the hedgers expect the underlying spot FX to show further dips so that OTM instruments would expire in-the-money (bids up to 112 levels).

To substantiate the above indications, we could see fresh negative bids in the EURJPY bearish risk reversal (RR) set-up that indicates the long-term hedging sentiments for longer tenors that are still substantiating bearish risks (refer 2nd exhibit). Courtesy: JPM & Sentry

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise