1 - 3 Month Outlook

The European economists are looking for both an expansion to the current asset purchase programme and a 20bps deposit rate cut at the ECB's December meeting. EUR/USD is expected to end the year closer to the bottom of the 1.08/1.15 range that has broadly held since May. EUR still trades as a risk off proxy, though as risk appetite has recovered, what was previously a source of support has turned into a liability. Policy now appears to be more imminently diverging between the ECB and the Fed/BoE.

At the Oct 22 meeting, Draghi signalled the central bank has shifted from "wait and see" mode to "work and assess". That was coupled with multiple other hints of further easing to come in December (an active discussion on depo rate cuts, use of the word "vigilant", increased downside risks to inflation, in part blamed on EUR's recent appreciation). Then more recently Draghi played down expectations, saying further stimulus is still an "open question" and that it is "too early" regarding decisions to cut the depo rate.

"We would see this as part of the theatre involved in trying to always beat market expectations (something the ECB has been particularly good at under the current presidency)", says RBC Capital Markets.

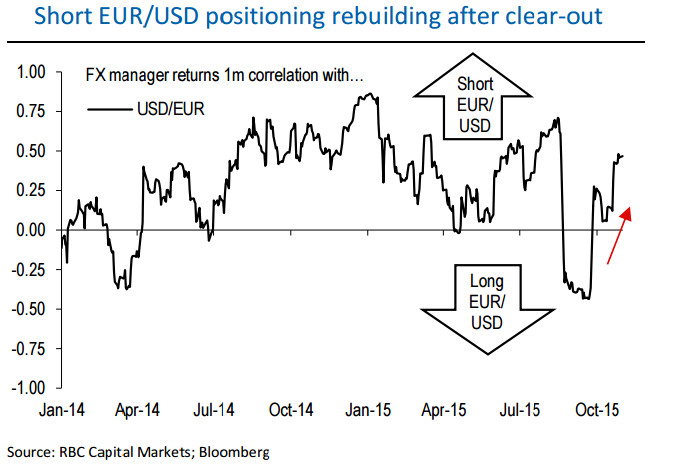

When the ECB decision comes on Dec 3, it seems likely to take into account expectations and go one step further. That coupled with rising probability for a Fed hike and lighter positioning should be enough to see EUR/USD trade lower again.

6 - 12 Month Outlook

The combination of tighter Fed policy, less extreme positioning and some central bank reserve liquidation, should be enough to push EUR/USD down to new cycle lows. The slow pace of recovery means it will be a long time before inflationary pressures start to show which should keep EUR/USD cyclically weak.

Euro Outlook

Thursday, November 5, 2015 9:57 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX