Driven by significant institutional purchases from BlackRock ($550 million, 3.6), Ethereum ETFs have recorded an amazing $1.53 billion in net inflows over four trading days. With a record single-day influx of $443.9 million on August 25, 2025, outpacing Fidelity ($87.4 million, 763,000 ETH), Grayscale (1.82 million ETH), and millions of ETH Bitcoin ETFs ($171 million) and raising ETH ETF assets to $30.2 billion, or 5.4% of Ethereum’s supply. Ethereum's price has risen to $4,500 thanks to this surge, aided by corporate treasuries holding 3.4 million ETH and investment advisers like Goldman Sachs ($721 million). Emphasized by VanEck's CEO and the GENIUS Act, a 6% weekly gain supports Wall Street's preferred blockchain infrastructure among rising stablecoin adoption and DeFi.

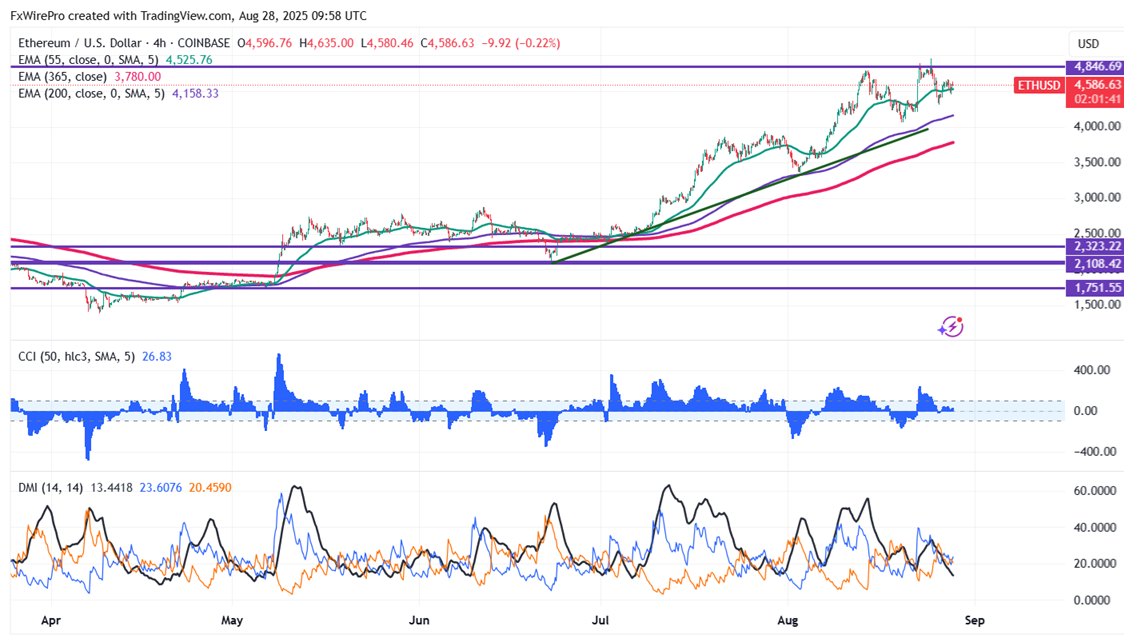

ETHUSD rebounds above $4500 on institutional demand. It hit an intraday high of $4635 and is currently trading around $4588. Overall trend remains bullish as long as support $3500 remains intact. Watch out for $4650, any break above targets $4770/$5000/$6000. A robust bullish trend will only materialize above $5000.

Immediate support is around $4200. Any violation below will drag the price down to $4000/$3700/$3550/$3500/$3380/$3200/$3000. A breach below $3000 could see Ethereum plummet to $2770/$2500.

It is good to buy on dips around $4300 with SL around $4000 for a TP of $5000/$6000.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate