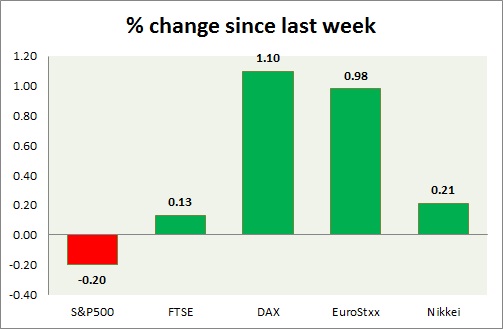

Equities Recovered well from yesterday's selloff and gained further ground over the ECB press conference. Performance this week at a glance in chart & table -

- S&P 500 - US benchmark recovered the loss from the support level but so far failed to gain that much traction like the benchmarks in other countries. It's currently trading at 2102. Immediate support lies at 2084 and 2040.

- FTSE - FTSE once again trying to break above the 7000 gaining favors over the comments from ECB. FTSE recovered its loss sharply after gaining on bids near the support area. It's currently trading at 6957, up 0.56% for the day. Support lies at 6870 and resistance near 6965.

- DAX - Today's ECB press conference seems to bore well for Germany as DAX sails to new all-time high after yesterday's rapid selloffs. DAX is currently trading at 11505. Immediate support lies at 11180 and resistance at 11520.

- EuroStxx50 - EuroStxx is gaining over Mario Draghi's comments and broken successfully above the psychological 3600 level. Press conference did well for over Europe stock markets. Germany and France both up by 1%, Italy by 0.9% and Spain 0.8%. EuroStxx50 is currently trading at 3622, up 0.9% for the day. Support lies at 3540.

- Nikkei - Nikkei has cut back the losses sharply after taking support around the mentioned level and looks like is going to challenge the 19,000 level pretty soon. Global risk on environment seems to be fueling today's move. Nikkei is currently trading at 18900. Immediate support lies at 18500 and resistance at 19,000.

|

S&P500 |

-0.20% |

|

FTSE |

0.13% |

|

DAX |

1.10% |

|

EuroStxx |

0.98% |

|

Nikkei |

0.21% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand