Reserve Bank of India's (RBI) governor Raghuram Rajan has taken up the right approach to curb volatility on the both side, and inform the market of his approach, while declaring that any fixed value of exchange rate is not targeted as it is not policy target.

Central bankers' suffering from high speed rising of Dollar against their exchange rate should take similar approach, rather than trying to apply breaks to the sell offs by use of reserves.

Interest rate shocks like what Russia did by raising rates by 6.5% to 17% in last December, which led to heavy buying into Russian Rouble, ending rout. However, that shakes up the domestic industry as well, which lowers economic activities for both businesses and households.

On the other hand steady and stable rise in interest rates midst heavy FX volatility fails to do the trick, which was seen in case of Brazil.

So why curbing volatility on both side works better?

This is no general thumb rule but at a time of turmoil, curbing volatility works better to contain the currency. However there are no replacements for mending the fundamentals, which works best in longer term.

In the short term exchange rates are more affected by portfolio flows.

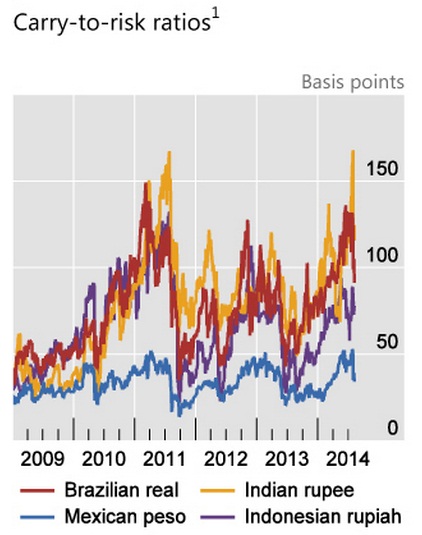

As emerging market currencies tend to benefit from carry trades, with volatility on the higher side, risk reward ratio tends to drop as shown in the figure resulting in further gyration and outflows. Classic example of this was seen during 2013 taper tantrum.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary